| Home | About | Archives | RSS Feed |

The Independent Investor: Epidemic Pulls Pork Prices Higher

|

The African swine fever could cause prices in China to spike 70 percent or more this year. The highly infectious disease is spreading throughout Asia and could lead to a large increase in the price of pork here at home as well.

Before you ask, this highly infectious virus, while deadly to pigs, is not harmful to humans. The problem is that when even one pig is tested positive, the entire herd needs to be slaughtered as quickly as possible. There is no cure.

The government is taking this epidemic seriously, and well it should. Tough new government rules have been implemented this month in Chinese slaughterhouses and processing plants to identify and test for the virus.

The Chinese are the world's largest consumers of pork, accounting for 49 percent of all pork consumed. Domestic hog production, prior to the epidemic, was roughly 700 million pigs. To date, only about a million pigs have been infected, but those figures may be understated. A Shanghai-based consultant company, JCI, is forecasting that pork production will fall by almost 16 percent this year to 8.5 million metric tons. That would leave roughly a 7 million metric ton shortfall in supply.

The government's inspection efforts have slowed down business and reigned in demand, at least temporarily. But given the popularity of pork in China, most producers are believed to have large stockpiles of pork supplies, most of which are in cold storage. As such, Chinese producers are dipping into their cold storage supply to satisfy demand and keep prices somewhat reasonable, at least until the second half of the year.

Given the severity of the epidemic and the wrath of the government, if the present guidelines and restrictions are ignored, producers and distributors don't dare to buy fresh pigs, kill them, or sell the meat until the government gives them an all-clear. In the meantime, the epidemic has spread to Vietnam and Cambodia, which are also big pork consumers, as well as other nations in Asia.

In order to fill China's shortfalls in supply, pork producers in Europe and the U.S. are starting to increase shipments to China. That is despite the fact that U.S. pork exports are subject to a 62 percent tariff, thanks to the tariff war between the U.S. and China.

There are also other side effects to the pork crisis. Soybeans are the major source of pig feed. Less pigs means less demand for soybeans. That also hurts U.S. producers. China had already cut imports from American soybean farmers and the virus simply reduces demand for our exports even further.

Chinese consumers may also be forced to substitute beef and other proteins for pork. That could send prices of beef higher since China already represents 28 percent of the world's meat consumption.

While there have been no known cases of the African virus here, the U.S. is already taking precautions. The National Pork Producers Council recently canceled its 2019 World Pork Expo in Des Moines. Our government also announced increased safety measures to prevent the virus from entering our livestock supply. Most of their effort is focusing on what is called additional attention to "farm biosecurity."

About the only silver lining for America in this stormy situation is the present tariff war. As we plan to levy even higher tariffs on just about all Chinese imports, the risk of importing infected pigs has been dramatically reduced.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: What Does Your 401(k) Investments Look Like?

|

It might surprise you to know that many retirement savers religiously contribute to their tax-deferred savings plans but have no idea what investments they own. Many plan representatives simply suggest that if you don't know, just invest in a target date retirement fund. Is this a good idea?

Most 401(k)s and 403(B)s plans, for example, have between 20 and 30 investment options you can choose from. This menu of choices normally includes bond and stock funds as well as international funds. There are also balanced or blended funds, which invest in a mixture of stocks and bonds. Many plans also have some kind of annuity-like investment as well as target date funds.

Supposedly, target date funds take the thinking out of investing. Let's say you plan to retire in 2040, so you select a target date fund that approximates that year. The rule of thumb states that the closer you get toward retirement, the more conservative one should be. That means you should have more bonds than stocks (according to Modern Portfolio Theory) in your investment portfolio as you age. Each year you draw closer to retirement, the computer model that actually manages these funds simply put more bonds in your portfolio and less stocks.

As a diligent saver who wants to make as much as one can before retirement, let's look at the track record of bonds versus stocks over the last ten years. In this case we have used Vanguard's intermediate term bond fund versus Vanguard's S& P 500 Index fund. But wait, you may say, the last ten years stocks have been up, up and away. So, let's make it 15 years, which includes the worst stock market plunge since the Great Depression. Bonds would have delivered a measly 4.88 percent versus 8.76 percent for stocks. That's almost a double. Over 10 years, stocks gained almost 15 percent.

Let there be no mistake, stocks do hold more risk than bonds. Case in point, in 2008, stocks lost over 35 percent, while bonds delivered investors nearly 5 percent. Fear and greed are motivational issues that govern everything we do in the financial markets. But, let's take a look at bond vs stock returns over the past 10 years.

| 10 Year Returns of $10,000 | ||

|---|---|---|

| Rate of Return | Ending Value | % Gain |

| 4.88% | $16,103.00 | 61.03% |

| 8.76% | $23,157.52 | 131.58% |

Those investors who were able to stomach the declines during the Great Recession were rewarded handsomely over those investors who fled to "safer" bonds. You need to decide the returns that your retirement account requires to reach your goals. Likely, that will mean adding stocks to the portfolio.

Back to the target date funds, a look under the hood reveals that you may own more bonds than you thought.

| JPMorgan SmartRetirement® | ||

|---|---|---|

| Year | Stocks percent | Bonds percent |

| 2020 | 37 percent | 63 percent |

| 2030 | 61 percent | 39 percent |

| 2040 |

76 percent

|

24 percent

|

| 2050 |

83 percent

|

17 percent |

| 2060 | 80 percent | 20 percent |

More bonds will make your retirement account less volatile, thereby giving you a smoother ride towards retirement. The price of that smooth ride will be the length of time it takes before you can comfortably retire. In the case of investing in target date funds, it may mean adding a few more years of working before you get to your destination. Are you OK with that?

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: What You Need to Know (But Don't) About Buying an IPO

|

An initial public offering of a stock, called an IPO, can be either a sucker's game or a chance for instant riches. Determining the outcome requires a great deal of work, knowledge, and luck. Most investors have none of the above when it comes to IPOs.

I want to share with you a recent conversation I had with a conservative client (a vegetarian and yoga teacher) on this subject.

"I want to buy some stock of this company that makes a vegetarian form of hamburgers. How do I do it?" she asked.

"Why do you want to buy it?" I asked, before explaining the mechanics of such a purchase.

"Well, it tastes really good, all my friends love them, so I'm sure it's going to be a great stock since more and more people will switch to this healthy choice of food."

What's wrong with this picture?

No. 1, her analysis is full of holes. Her first mistake is failing to recognize three crucial differences. A good product does not necessarily translate to healthy corporate profits. Many a company with a good product has failed miserably because they did not have the knowledge, experience and financial acumen to make a go of it as a public company in a competitive marketplace.

No. 2, it does not necessarily follow that a company with good fundamentals will also perform well in the stock market. There are thousands of cases throughout financial history where companies that IPO never again reach their offering price.

And three, if you think it is hard enough to analyze the fundamental valuation and technical position of an already-established public company, imagine the difficulty in trying to do the same for a company with no historical data, and even worse, that sells a new or innovative product that is little understood.

Let's look at some of the other mistakes in financial logic my client is making. How many vegetarians are there in the U.S. versus meat eaters? The latest research (2017) put the number at 7.3 million Americans or 3.2 percent of the country's population. That's not a very big market, but she believes that once more people "discover" this non-meat burger, they too will find religion and give up meat.

Going public, however, won't change that. This particular company is already distributing its products (non-meat, non-chicken and non-sausage) in dozens of national food chains and stores throughout the nation and overseas.

She also needs to recognize that if this plant-based array of products is so good, competitors won't just sit still, they will imitate and offer their own plant-based products. In this case, it is already happening. Burger King is marketing a meatless "Impossible Burger." Reports indicate it is at least as tasty as my client's company's product.

Buyers of IPOs should also be aware that these offerings are normally handled by big brokerage houses that know how to promote a new issue and will, for a short time, support its price. Normally, brokers insist that company insiders have a "lock-up" period for a few months before owners and employees can sell their stock. When the lock-up period is over, an avalanche of sell orders hits the market. A look at most IPO stock prices a few months after going public shows a steep drop in price, most often well below the offering price.

Some retail investors don't care because they are planning to "flip" the stock. You buy the IPO after it begins to trade (usually at a higher price than the initial offering price), and then sell it for a profit over the next few days. That's where your luck comes in. Your odds of making money are equal to how much hype there is surrounding the stock.

Don't be fooled, some IPOs do skyrocket and never look back. You can take your chances, or have some patience, wait a few weeks or months and then, after doing your homework, make your investment. It's not as exciting, but it has been proven to be a better investment style over time.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

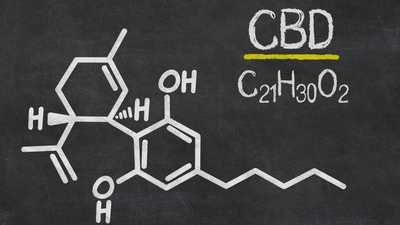

The Independent Investor: CBD Is a Real Market

|

Cannabidiol is popping up all over the country. Local drug stores, supermarkets and health food shops, among other retailers, can't seem to get enough of this stuff on the shelves. Is this a fad, a fake, or does it have some real health benefits?

It's called CBD, for short, and this oil can be eaten, inhaled, and/or applied to the skin. It is a substance extracted from the flowers and buds of the marijuana and hemp plant. And no, before you ask, you can't get high from it.

Back in the day, (when I had hair to my shoulders, along with my buckskin jacket) I simply smoked marijuana or ate it in cookies. It contained THC. THC, a chemical, attaches to the CB1 receptors in the brain and triggers all those familiar sensations like increased appetite, giddiness, moods swings, etc. Unlike THC, CBD was at first thought to attach to the CB2 receptors, which does not trigger psychoactive sensations. You don't get a buzz from it, although for someone like me that is no longer important.

The FDA allows CBD to be prescribed for epileptic seizure disorders and other ailments, but the research for other uses is till ongoing. Most consumers are using it for things like anti-inflammation and pain, especially for arthritis and injuries. Diabetes and acne are also conditions where CBD is used. Others believe it may have properties to treat Alzheimer's disease. Whether any of these claims are true, will be borne out in time through research.

Given my own arthritis issues, I decided not to wait to try it on my neck problems. It worked. The pain vanished for an entire day. I gave some to my neighbor, who has the same condition. It worked on him as well. Certainly, that is no scientific study, just personal experience. Now, what you should know is that CBD can be derived from both hemp and marijuana plants, which are similar, but not identical. Thanks to the Agricultural Improvement Act of 2018, hemp is now legal to grow and sell. Marijuana is not. The CBD, which is derived from hemp is legal, as long as it contains less than 0.3 percent THC.

Sales of hemp-derived CBD oil four years ago was around $90 million. By next year, sales are estimated to top $450 million. If, over the next year or so, the federal government allows marijuana-derived CBD to be legally sold, the CBD market could generate as much as $1.2 billion in revenues.

CBD crystals are the purest form of the product. It can be dabbed, made into a tincture, or used as an edible by mixing it with high-fat foods. Topicals and salves can be sold as soap, lotions, even shampoos. It can be inhaled as a wax or inhaled as a vapor, as well as eaten in chocolates, baked goods, and even gummy bears. Pills and capsules are now marketed as nutritional supplements as well.

By the way, Titus, our ten-year-old Chocolate Lab, has been eating CBD-infused snacks for over two months now. Like me, Titus suffers from arthritis (me in the neck/back, him in both shoulders). Since he has many of the same brain receptors that I do, CBD works well on his arthritis as well

While pot stocks overall remain the darlings of the stock market, at least those companies that sell the legal form of CBD may have some real value. As for the companies that market the THC-based products, the risk is much higher. Under federal laws, growing and selling marijuana is not legal, at least until the U.S. government and more states pass new legislation that would legalize those products. That should happen within the next 12-18 months, according to both company managements as well as some legislators.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: The Cost of Rebuilding God's House

|

Sometimes a tragedy can bring people together. In the case of the devastating fire that swept Paris' Notre Dame Cathedral, the world wept. But even before the fire was completely extinguished, the business community was already making plans to rebuild the 850-year-old edifice.

The price tag will likely be in the multibillion-dollar range. A preliminary assessment of the damage thus far includes two-thirds (about 100 meters) of the roof and the destruction of a spire, which the world witnessed on television. At least a 62-foot expanse of stained-glass windows was also severely damaged.

What we don't know as of yet, is how the 800-pipe organ, one of the largest in the world, fared through the fire. Much of the art work has been saved thanks to the 400 firefighters, who, in addition to battling the blaze, carried artwork and priceless relics, such as Christ's crown of thorns, to safety. In a stroke of luck, an additional 16 ancient religious statues had already been removed last week for cleaning.

Many architects worry that the fire could have weakened the stonework of the cathedral. Hand-carved over 200 years of construction, the ancient stone can turn to dust in extreme heat through a process called calcination. Pouring cold water on that hot stone can also cause it to weaken and crack. The two rectangular bell towers were saved, despite the fire's spread into one of them, and credit for that accomplishment should go to the French firefighters, who battled the blaze for 15 hours.

Before the last smoke cleared, business leaders were already pledging their support to re-build. Within 24 hours of the disaster, two of France's richest men pledged 300 million euros to re-build the historic landmark. By Wednesday morning, that total has climbed to 450 million euros with the largest donation made by the LVMH Group. LVMH owns Louis Vuitton, Givenchy and Christian Dior and has pledged 200 million euros ($226 million). The Pinault Family, which controls Kering, a French luxury brand that owns Gucci and Yves Saint Laurent, chipped in an additional $113 million ($100 million euros)

But the economic blow will go far beyond the damage to the cathedral itself. Over 50,000 visitors per day (an estimated 13 million a year) make the pilgrimage through the dark, candle-lit interior of the church and into its crypt. Although the cathedral is free to enter, it costs 8.50 euros to experience the tower and an additional 6 euros to explore the crypt. I did both on my last excursion to Notre Dame and it was well worth it.

If I assume only half of those tourists are like me and are willing to pay the additional charges, it still comes to as much as $225 million per year in revenues. But maintaining those hallowed halls is not cheap. Basic renovations cost in excess of $4.5 million per year. There are also estimates that just conducting essential structural work in the future would require almost $200 million, and that was before the blaze.

The cathedral has survived more than its fair share of misfortune through the years. It was a target of protest during the French Revolution, for example, when it sustained considerable damage. Twenty-eight statues of biblical kings in the cathedral were pulled down with ropes and decapitated by mobs. Its bells were once melted down for artillery cannon. At one time, it was used as a warehouse.

Napoleon Bonaparte was crowned emperor in 1804 and saved the church from demolition after centuries of decay and neglect. Restored by Napoleon and once again used as a place of worship, the church thrived. In 1909, Joan of Arc was beatified there.

Through the years, this premier example of Gothic architecture has been rebuilt and/or reconstructed many times. It appears that much of the present damage occurred in that part of the building that had been restored in the 19th century. The truly old parts of the church constructed in the 10th, 11th and 12th centuries escaped damage. It could have been another lucky break or maybe the silver lining in this dark cloud of misfortune.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.