Pittsfield OKs Tax Incentive For Hotel; Delays One For Science Center

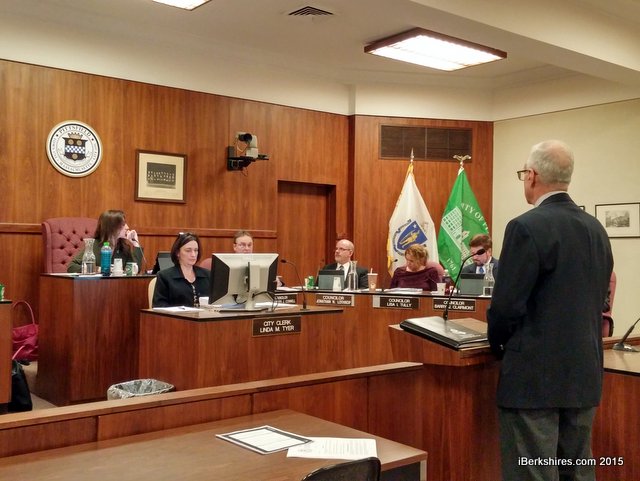

Director of Community Development Douglas Clark told the City Council about the TIF for the Berkshire Innovation Center. Director of Community Development Douglas Clark told the City Council about the TIF for the Berkshire Innovation Center. |

PITTSFIELD, Mass. — The City Council is giving the developers of Hotel on North leeway in its taxes for the next seven years.

But, councilors opted to delay approval of a similar 20-year agreement for the Berkshire Innovation Center.

The 45-room, under-construction Hotel on North is expected to create 21 new jobs and raise the property value of the downtown building by some $2 million. The tax increment financing agreement approved Tuesday night delays the full taxation of the improvements for seven years.

"Not only will Hotel on North create all of these jobs but also contribute to the revitalization of North Street," said Michelle Butler, an attorney who represents the company.

The owners, Due North Hospitality, would pay taxes on the current assessment and each year pay more and more of a percentage of the added value. In the first year, 100 percent of the new taxes would be forgiven; in year two, it would drop to 80 percent, then 60, 40 and 20 percent, then 10 percent in the final two years.

"This is not a free ride for them. They'll pay taxes on the value as it is now and each year they'll pay more," said Councilor at Large Barry Clairmont.

Only Councilor at Large Churchill Cotton opposed to the agreement. He said he believes the agreement should have been for only five years.

Ward 6 Councilor John Krol, however, said he'd push it out to 50 years if he could because he supports the project.

"I'm thrilled by this investment. I'm glad we are doing a seven-year, which is the max we could do. I wish we could do more," Krol said.

Butler said the property had already been granted TIF agreements in the past and there are only seven years remaining. One property can only receive 20 years of tax breaks.

"This seven years is the remainder of what is allowed by statute," Butler said.

Community Development Specialist Ann Dobrowolski said the city will see increased revenue from meals taxes and will continue to see meals taxes generated (the former use was two restaurants).

"We are also receiving something from that location we never received before, which is the hotel tax," Council Vice President Christopher Connell said.

If the company does not create the 21 required jobs, the agreement can be decertified and the full taxation implemented.

A 20-year agreement that would lift all taxes on the Berkshire Innovation Center wasn't approved Tuesday night. The city was awarded a $9.75 million grant to build the new science center that will serve as an incubator for small and medium-sized businesses.

The organization is planning to break ground in June on a site in the William Stanley Business Park; the city will ultimately own the building, so it won't be taxed anyway.

However, the center will receive some $2 million in equipment through the grant that is subject to personal property taxes. The TIF the City Council delayed would have alleviated the tax burden for that.

Clairmont led the charge to table the motion saying he didn't want to agree to the TIF without seeing a lease between the city and the BIC.

"I think we should have all the pieces in front of us before we approve the TIF," Clairmont said.

Clairmont had particular concern over the language in the lease and the conveyance of equipment.

For the building, Clairmont said he doesn't believe the city should be forced to make major capital repairs in the future on a building that is helping private companies. He wanted to see the lease outline those details.

And for the equipment, he called for some type of agreement that will ensure the non-profit couldn't sell it and use it to offset operations or salaries. He wanted to see the conveyance agreement to ensure that wouldn't happen.

"I am definitely in support of the concept of the BIC not paying any real estate taxes. They just don't have the funds to do it," Clairmont said to clarify his stance that he isn't against the tax relief but rather just wanting to delay it longer.

Director of Community Development Douglas Clark said the TIF agreement presented Tuesday has a clause in it that says if a lease agreement isn't reached and approved by the City Council, it is voided. The idea was to separate the various steps needed to make the project happen.

He asked the council to approve the TIF agreement first and then focus on the lease for a future meeting.

"There will be a conveyance agreement and that will come before council. The lease agreement will come before council. So, there is adequate time to take care of [Clairmont's concerns]," Clark said. "All we are asking for here is that the BIC not be taxed for real estate and personal property. The best way to do that is through a TIF."

Clark said the TIF needs state approval and the city and the organization wants to submit the application in time for the March meeting, which means the application needs to be sent in by the end of February.

Ward 7 Councilor Anthony Simonelli, however, said, "it would make sense to hold off until the lease comes" and do it all at once. The City Council voted 6-5 to table the discussion until it could review all the documents.

Krol initially voiced favor of the TIF and agreed to approve it. But when the vote came he voted to table it instead.

Krol explained that Clairmont, who spoke a second time after Krol, had pointed out that the mayor had signed lease agreements without City Council approval before. Krol said didn't want the same thing to happen again. That ultimately swayed him to become the swing vote against it.

Tags: innovation center, leasing, motels, hotels, tax incentive,

Director of Community Development Douglas Clark told the City Council about the TIF for the Berkshire Innovation Center.

Director of Community Development Douglas Clark told the City Council about the TIF for the Berkshire Innovation Center.