NORTH ADAMS, Mass. — The City Council set a 1.67 tax shift for fiscal 2021 that will mean 2 cents more on the residential tax rate and 83 cents less on the commercial rate.

The council voted 6-3 to approve the shift after nearly 90 minutes of debate focused on the fairness of shifting the tax burden toward the residential during Tuesday's annual tax classification hearing. Councilors advocated for lowering the shift to help business as an economic driver while the no votes said it was unfair to further burden homeowners.

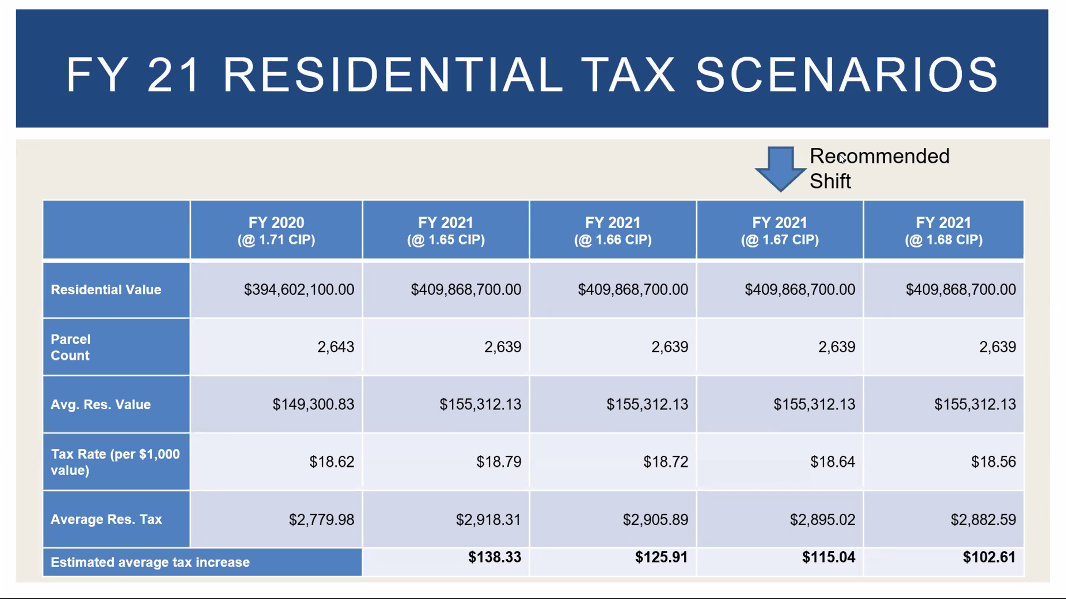

The estimated tax rates are $18.64 per $1,000 valuation and $39.83 for commercial, industrial and personal.

The average value of a single-family home is $155,312.13, up about $6,000 from last year. That means the average tax bill will go up $115.04, from $2,779.98 to $2,895.02. In contrast, the average commercial value is $423,000 meaning the average tax bill will be $16,850 — down from around $17,087 last year.

The city's valuation rose by $38,858,643 — about half that in residential — to $806,872,730. Total new growth was $4.4 million, almost all in personal property because of a change in how utilities are assessed as the result of a court case.

Mayor Thomas Bernard said he had recommended the shift of 1.67, down from 1.71 last year. The differential shifts more of the tax burden onto the commercial side, which is usually a smaller component of a community's value, and has been in the 1.71-1.75 range in for years.

"Based on conversations again in past years. I felt it was important to bring the commercial tax rate below $40," he said. "We've had conversations when it went above $40 about what that meant. Psychologically what that meant competitively, and I felt like it was important that for this year, as everybody is struggling, everybody's hurting you made that point that we we achieve the goal of going under 40."

Councilors Jason LaForest and Marie Harpin, however, argued that this year wasn't the time to putting more burdens on homeowners.

"At this point in time, I think this shift to give a break to the commercial side is difficult to vote yes for," said Harpin. "We've been very generous with the shift to the commercial, and based on the information that I'm seeing and the taxes that are not being paid, it seems like our residents are having a difficult time."

Harpin said it wouldn't only be small businesses benefiting from the drop in taxes but larger corporations like Cumberland Farms and Walmart. LaForest pointed out that the council had lowered the commercial shift last year to 1.71.

"I would imagine because you know COVID aside, that the residents of North Adams are feeling pretty strapped and having to make tough decisions about their personal budgets at home," said LaForest, adding later, "I believe I was one of the loudest advocates

last year to move the shift in the direction that we did, but there is such a thing as a slippery slope ... I think this is an unfair shift to the property owners, the residents of the city and I think Councilor Harpin's point about giving excess cuts to the bigger taxpayers, the bigger industries in town is more than valid."

LaForest questioned why the choice of shifts was in the 1.6 range rather than 1.7 as it had been before. City Assessor Ross Vivori said the choice of shifts was the end result of a series of calculations done with the Department of Revenue. The city had four options running from 1.65 to 1.68; the difference between the smallest to the largest shift was $36 on the average tax bill.

Councilors Keith Bona and Benjamin Lamb both advocated for reducing the commercial rate below $40. Some residents are hurting, they acknowledged, but many of those who were unemployed were able to get the $600 to get them over the hump. And larger corporations had the access to federal protection plans and loans that small businesses have difficulty even applying for. Plus businesses often pay higher rates for utilities and other obligations that homeowners don't have.

"I believe the businesses were hit harder this year, far more than the residents, and I think we've seen a number of them close for some reasons and I believe a lot of them are just hanging in there," said Bona, who is a small-business owner. "Especially with uncertainty of what still may come, there could be another shutdown. ...

"When you start seeing $40, you know, per thousand on your commercial rate, that's a scary number to small businesses."

Lamb, an economic development specialist, said that figure isn't the only piece that entrepreneurs consider when deciding where to start a business. But, he said, "it is an important piece. It is something that psychologically affects people when they see that rate number, and it is part of conversations that I do have on a daily basis."

"I do think that when we're looking at sustaining businesses that already exist that we have very limited opportunities to support, and also recruiting new businesses by having an under 40 rate, those are key aspects to our economic growth as a city," he said.

Harpin said she had calculated over the last five years that residential rates had risen higher percentagewise than commercial, even though the commercial annual rate was higher. "It's just really hard for me to put the priority on the businesses right now," she said.

Councilor Jessica Sweeney, the third no vote, agreed.

"I see the points in attracting businesses to our community but I have to agree with Councilor Harpin about the impacts our residents are facing right now," she said. "I'm one of those people who's been struggling immensely during this time, financially, and I know many of my peers are struggling as well ... The holidays are coming up, things are really challenging, and I have a hard time on supporting raising the taxes on our residents right now."

No public participated in the hearing and no councilor motioned to change the shift. It passed with a majority vote.