| Home | About | Archives | RSS Feed |

The Retired Investor: Polling Business Takes a Body Blow

|

There has been one clear loser thus far in the outcome of the 2020 presidential elections and it is not the candidates. The polling industry has gotten it wrong twice in a row. Can the industry survive that kind of mistake?

As votes across the nation continue to be counted, the pollsters and the media, which count on those polling results, are asking how Vice President Joe Biden's 10-point lead nationwide could have evaporated in the blink of an eye.

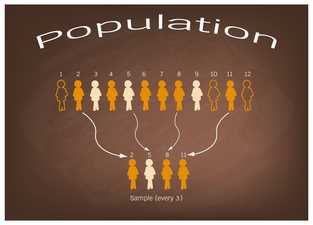

Political polling is a type of public opinion polling, which in the past (when done right), is a fairly accurate social science with established rules about sample size, random selection and margin of error. The top political polling organizations employ mathematical models and computer analysis to collect a response from the best representative sample of the voting public. Over the past three years, the Marketing Research and Public Opinion Polling industry in the U.S. has averaged an annual growth rate of 2.3 percent to reach $20.6 billion in revenue. And yet, this multibillion-dollar industry would admit that there is still plenty of "art" in this science of political polling.

Unfortunately for pollsters, it is the art side of interpretation that seems to have gone radically awry for the second time in eight years. In my opinion, it is sure to only heighten the suspicion and distrust many Americans already have towards polling after the 2016 performance.

During the last four years, there has been a lot of soul-searching among the polling community on what went wrong. Their answer: not much.

The polling industry has argued that President Donald Trump's 2016 win fell within the normal statistical error implicit in all polls. Essentially, Trump beat the polls by just a few points in just a few states. So, from their point of view, the presidential polls were not that far off. However, at the state level, the polls were even less accurate, but the industry still maintained that they were within the normal range of accuracy.

Some pollsters, however, did adjust their methods of polling to improve their accuracy. One modification was to emphasize the importance of education. Polling organizations realized that they were missing some of the president's support in the last election by underrepresenting voters with little or no college education. Pollsters also placed more emphasis on where respondents lived. Did they live in a city, suburb or rural area, for example?

Another improvement was the decision to rely more on cell phones — instead of landlines — as a method of reaching respondents. This has had its own problems, however, since pollsters are finding that the response rate to phone calls is decreasing. At the same time, the costs to conduct high-quality polling are going up. Pollsters can still resort to online polls, but most firms believe online interviews are less accurate than live-caller polls result.

In preparation for this election, pollsters were worried that the pandemic could alter the accuracy of their polling in unpredictable ways. Some voters, for example, could tell a pollster they planned to vote, but a sudden spike in coronavirus cases in their area might force them to change their mind. They might avoid election day voting booths and opt to vote by mail or not at all.

The huge number of mail-in ballots alone might create uncertainty. Questions of accuracy, disqualifications, and court challenges might throw off the predictions in unpredicted ways.

Unfortunately, none of that matters in the minds of the public. The failure to hold the 8-9, even 10-point lead for Biden in this election was so far off the statistical margin of error that pollsters may not be able to dig their way out of the doghouse. But you can bet that they will try.