| Home | About | Archives | RSS Feed |

The Retired Investor: Small-Town America Is in Vogue

|

The on-going coronavirus pandemic has boosted consumer demand for small-town real estate. Whether that trend will continue with a vaccine on the horizon is anyone's guess.

In the meantime, it could be a godsend for those looking to retire and possibly downsize during this period. The obvious driver in this trend change has been the safety factor. The devastating carnage that occurred in the nation's large cities during the first surge of the coronavirus convinced many families to pull up stakes and find dwellings as far from the mayhem (and people) as possible.

Home listings in small towns jumped more than 100 percent this spring, according to Redfin, while viewings of rural county properties increased by 76 percent. But relative safety was only one of the draws. The ability to work remotely had opened up possibilities to re-evaluate and rethink lifestyles. That became especially appealing for those who had faced long daily commutes and extended work hours. The pandemic also curtailed, or even shut down, many of the reasons consumers enjoyed the urban centers in the first place, such as restaurants, bars and other leisure activities.

From a financial point of view, low mortgages rates (thanks to the Federal Reserve Bank's monetary stimulus) have made borrowing mortgage money more affordable. Property prices are also much more reasonable when compared to housing in places such as New York City, Boston, or San Francisco. Buyers also benefit from lower taxes generally.

In many cases, a young family's plans to move out of the big city in a couple of years was simply hastened by the pandemic. Others found that the coronavirus was the excuse they needed to move closer to aging parents or find a place that offered a guesthouse for other family members.

And these days, where most leisure activities involve the great outdoors, the appeal of living somewhere rural is an added draw.

For many, small towns are a good choice. At some point, (when things return to normal), most work-at-home employees plan to go to the office a few times a week. As such, a convenient transportation system is a priority. Many small towns offer train, bus, and even airport services nearby. My own small town (well city), Pittsfield, offers all three, plus a wealth of other services for new home buyers.

As someone who has lived in the back-country, take it from me, when it snows commutes become a nightmare. I also found that without good internet service working from home is practically impossible. Something I discovered too late when I moved to the "boonies."

The pandemic has even made school choices easier for many moving parents and their kids. Many children are still attending virtual schooling and they don't get to socialize with their friends, except through the computer. As such, a move to somewhere else may not be as life-changing to many children as it could have been under more familiar circumstances.

All of this is good news for the segment of the population who are retired or planning to retire. For many aging Americans, that four-bedroom house of forty-some years with the big backyard and front lawn has long since emptied out. The children are gone. The driveway is too long to plow and even the garden is taking more effort than it used to.

For those thinking of downsizing, the timing couldn't be better.

@theMarket: Markets Enjoy a 'Biden Bounce'

|

The nation spent most of the week wondering who won the presidential elections. While lawsuits, protests, and dueling press conferences occupied the airwaves and internet, global stock markets spent the time discounting the results. Have markets already picked the winner?

A Joe Biden win, with a Democrat House, and a GOP-controlled Senate was the conclusion reached by the markets on Tuesday. The "blue wave" that investors had expected and believed would unleash trillions of dollars' worth of stimulus, run up the national debt, and cause long-term interest rates to rise, was off the table. Instead, we would face at least two, if not four, years of political inertia. As I have written before, the financial markets thrive on the status quo and on deadlock. As such, the focus this week was on buying up equities that investors believe will benefit from a new political landscape.

"But wait a minute," say the bears, the vote is just too close to count in several states to make such a prediction. The make-up of who controls the Senate may come down to two Senators in a Georgia run-off in January. And what about the avalanche of lawsuits that the Trump campaign has announced?

None of the above seems to matter to the bulls. Biden's chances keep improving all week in most states, which add fuel to the equity bonfire. Trump's lawsuits were expected. The president telegraphed his intent to sue even before the elections. Investors do not see any proof that there was any wrong doing outside of the usual snafus and mistakes that take place in every election. As for the Senate, right now the numbers are split evenly between the two parties. Until and when that changes, there is gridlock on the legislation front.

Under the present market scenario, any disappointment that investors won't be getting a $2 trillion-plus new stimulus package (as presented by the Democrats before the election) has been somewhat alleviated by the belief that a smaller package could be passed before the end of the year. Senator Mitch McConnell said as much this week.

This is important, because the second wave of coronavirus is already underway, and is expected to worsen in November through January. We need a stimulus package passed now in order to help the economy (not to mention the nation) through this winter.

A blue wave stimulus package, most believe, would have had to wait until February when the Democrats took control of the House and the White House. By then, the damage would have already been done. Funny enough, with a divided Congress and new president, investors now believe the chances of compromise are higher than previously.

Bond markets have also breathed a sigh of relief. Without a humongous stimulus package, the government would not be racking up as much debt to an already-ballooning deficit.

On the tax front, equity investors have decided that a divided Congress would also put an end to all of Joe Biden's talk about individual and corporate tax increases. It is doubtful, believes Wall Street, that a Republican-controlled Senate would be enthusiastic about passing any increase in taxes.

On the healthcare front, while both sides might agree to some necessary compromises to fix the holes in Obamacare, there likely would be little movement toward more government control of the nation's health care system as threatened by Bernie Sanders and the left.

This belief that changes in taxes and healthcare policies would no longer be a threat to investors is one of the reasons the technology and healthcare sectors took the lead in this week's rally. Globally, Emerging markets and China stocks also did well. The thinking here is that while Biden may still be tough on China, his actions will be more measured and diplomatic. The unsuccessful on-again, off-again tariff strategy of the previous administration would likely take a back seat to coordinating a policy with other nations that might also harbor China trade grievances.

That said, I expect some pullback in the markets after this week's run up, but that doesn't make me bearish on the stock markets. Instead, I still see gains throughout the remainder of the year and new highs for the S&P 500 Index and NASDAQ. The U.S. dollar may also continue to slide. In which case, foreign markets (especially emerging markets), resource plays, basic materials, industrials, and precious metals sectors should continue to gain as well.

However, I remain greatly concerned that in the weeks ahead the pandemic will get much worse across the nation. COVID-19 cases and deaths are expected to rise. Most of the macroeconomic numbers still indicate a rebound in the economy, but that is backward looking data.

Rural hospitals, especially in those parts of the country that have not followed medical protocols, look to be coming apart at the seams. I expect the government will continue to sit on its hands (except to pass a smaller stimulus bill) and hope for a breakthrough on the vaccine front. But hope is not a strategy. If the economy and employment gains slow and even reverse in the meantime, investors would probably be looking to the Fed once again to save the markets, and I expect they will.

The Retired Investor: Polling Business Takes a Body Blow

|

There has been one clear loser thus far in the outcome of the 2020 presidential elections and it is not the candidates. The polling industry has gotten it wrong twice in a row. Can the industry survive that kind of mistake?

As votes across the nation continue to be counted, the pollsters and the media, which count on those polling results, are asking how Vice President Joe Biden's 10-point lead nationwide could have evaporated in the blink of an eye.

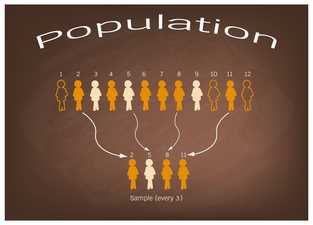

Political polling is a type of public opinion polling, which in the past (when done right), is a fairly accurate social science with established rules about sample size, random selection and margin of error. The top political polling organizations employ mathematical models and computer analysis to collect a response from the best representative sample of the voting public. Over the past three years, the Marketing Research and Public Opinion Polling industry in the U.S. has averaged an annual growth rate of 2.3 percent to reach $20.6 billion in revenue. And yet, this multibillion-dollar industry would admit that there is still plenty of "art" in this science of political polling.

Unfortunately for pollsters, it is the art side of interpretation that seems to have gone radically awry for the second time in eight years. In my opinion, it is sure to only heighten the suspicion and distrust many Americans already have towards polling after the 2016 performance.

During the last four years, there has been a lot of soul-searching among the polling community on what went wrong. Their answer: not much.

The polling industry has argued that President Donald Trump's 2016 win fell within the normal statistical error implicit in all polls. Essentially, Trump beat the polls by just a few points in just a few states. So, from their point of view, the presidential polls were not that far off. However, at the state level, the polls were even less accurate, but the industry still maintained that they were within the normal range of accuracy.

Some pollsters, however, did adjust their methods of polling to improve their accuracy. One modification was to emphasize the importance of education. Polling organizations realized that they were missing some of the president's support in the last election by underrepresenting voters with little or no college education. Pollsters also placed more emphasis on where respondents lived. Did they live in a city, suburb or rural area, for example?

Another improvement was the decision to rely more on cell phones — instead of landlines — as a method of reaching respondents. This has had its own problems, however, since pollsters are finding that the response rate to phone calls is decreasing. At the same time, the costs to conduct high-quality polling are going up. Pollsters can still resort to online polls, but most firms believe online interviews are less accurate than live-caller polls result.

In preparation for this election, pollsters were worried that the pandemic could alter the accuracy of their polling in unpredictable ways. Some voters, for example, could tell a pollster they planned to vote, but a sudden spike in coronavirus cases in their area might force them to change their mind. They might avoid election day voting booths and opt to vote by mail or not at all.

The huge number of mail-in ballots alone might create uncertainty. Questions of accuracy, disqualifications, and court challenges might throw off the predictions in unpredicted ways.

Unfortunately, none of that matters in the minds of the public. The failure to hold the 8-9, even 10-point lead for Biden in this election was so far off the statistical margin of error that pollsters may not be able to dig their way out of the doghouse. But you can bet that they will try.

|