| Home | About | Archives | RSS Feed |

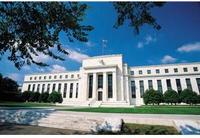

@theMarket: Fed Gives Green Light to Stocks

|

The Fed also said it would consider launching a bond-buying program and it wouldn't wait for a recession to do it. Fed Chairman Ben Bernanke hinted he would act if the economy and unemployment simply continues to recover at its present slow pace. At the same time, the Fed dropped its forecast for economic growth this year from a range of 2.5-2.9 percent to 2.2-2.7 percent. He targeted a 2 percent inflation rate for the country but also said he would be willing to see inflation a bit higher if it meant producing more jobs for Americans.

What all of this means for you and I is that the Fed is determined to do all it can to goose the economy, the stock market and the housing markets. In the past, when the Fed conveyed this kind of message to investors, the stock markets climbed higher. I expect the same thing to happen again this time.

It is not yet clear to me how telegraphing their determination to push longer-term rates lower over the next two-plus years is going to help home buyers decide on purchasing, as opposed to renting. If, for example, I was in the market for a fixed rate mortgage and I know rates might trend lower between now and 2014, I would be in no hurry to sign a contract.

The Fed's announcement is also bad news for those retirees who have fled the stock market and have their money invested in "safe" assets such as CDs and U.S. Treasury bonds. They will continue to receive next to nothing for their money while struggling to make ends meet as food, energy, medical services and other necessary living expenses continue to rise.

On the plus side, investors can be pretty sure that the economy won't get any worse and that the stock market is about the only place one can hope to achieve a reasonable rate of return on your investments. Of course, there will be the inevitable piper to pay down the road but central banks around the world have decided to worry about the inflationary consequences of trillions of dollars in stimulus when it happens. Future inflation fears is one reason that commodities led by gold and silver raced higher after the Fed meeting.

So do the Fed's actions change the bottom line of my investment strategy? Not really. I believe defensive areas of the stock markets (those stocks and sectors that pay dividends) will do just fine in this environment. High yield and investment grade bonds will also do quite well. We will still have pullbacks in the market this year and some of them might even be serious. Overall, I believe we are exactly where we should be.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at (toll free) or email him at wschmick@fairpoint.net. Visit www.afewdollarsmore.com for more of Bill's insights.