Non-Profit Agencies Relieved Donation Cap Not Passed

|

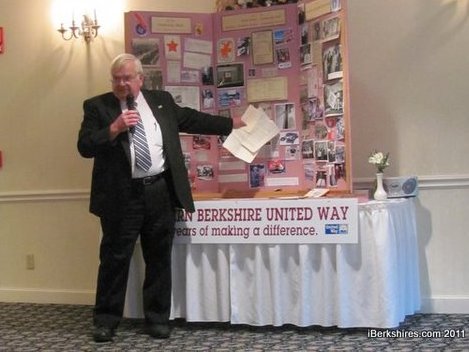

The Northern Berkshire United Way celebrated its 75th anniversary last year. The agency and other non-profits were relieved that the fiscal compromise did not include a cap on charitable giving. |

NORTH ADAMS, Mass. — Leaders and fundraisers for non-profit groups nationwide took a step back from the edge of the "fiscal cliff" last week, but they likely will not forget how close they came to the abyss.

The American Taxpayer Relief Act passed New Year's staved off the Armageddon scenario of massive federal tax increases coupled with spending cuts. And the compromise that passed the House of Representatives managed to avoid one crisis without sparking another.

As recently as New Year's Eve, published reports out of Washington, D.C., were speculating that the "cliff" legislation would include a cap on tax deductions for charitable donations — a move that could have crippled non-profit organizations nationally and here in the Berkshires.

"We, along with so many others, are relieved that Congress and the White House collaborated to pass this legislation," Berkshire Taconic Communication Foundation President Jennifer Dowley said in a news release late last week. "Many negotiations lay ahead, but meanwhile, one layer of uncertainty has been removed."

In North County, the executive director of the Northern Berkshire United Way agreed.

"We've been following it closely," Joseph McGovern said as news began to trickle out about the late Tuesday vote in the House. "Obviously, there would have been a huge impact on some of our major donors. A lot of our larger gift-givers rely on (the tax deduction) and make gifts based on that.

"We were very nervous."

Northern Berkshire United Way has 22 member agencies throughout the region, including the Northern Berkshire Community Coalition, Goodwill Industries of the Berkshires and the Elizabeth Freeman Center. The Sheffield-based Berkshire Taconic fund distributes more than $7 million annually to non-profits and individuals in the arts and education, health and human services and environmental protection throughout Berkshire County, northwest Connecticut and Columbia and Dutchess counties in New York.

Those groups and others are spreading the word that deductions for charitable contributions will not be adversely affected by the law. In fact, one provision in the "fiscal cliff" compromise actually encourages contributions.

"[T]he charitable deduction will continue to be coupled with an individual's or household's corresponding tax rate," the BTCF news release states. "For example, under the new tax law the highest tax bracket will be 39.6 percent. Therefore, affected earners can deduct 39.6 cents for every dollar donated."

One change the law does make is an extension of the Individual Retirement Account charitable rollover provision through Dec. 31, 2013. That allows tax-free distributions from IRAs held by Americans 70 1/2 and older up to $100,000 per taxpayer, per taxable year, retroactive to Jan. 1, 2012.

Both BTCF's Dowley and NBUW's McGovern credited the efforts of non-profit groups in Washington, D.C., with helping defeat the idea to cap charitable deductions.

"I know United Way Worldwide had representatives down there lobbying," McGovern said. "If this thing happened, it was going to trickle down and hurt a lot of people."

BTCF is a member of the Council on Foundations, which on Wednesday morning started spreading the good news to its members while emphasizing that the idea of capping deductions for charitable donations could re-emerge at a later date.

"Congress will address more comprehensive tax reform in 2013, and we must continue advocating about the important role philanthropy plays in our society," the Council of Foundations' Wednesday email to membership read.

Berkshire Taconic's Thursday news release, in addition to touting the benefits to people served by non-profit agencies, pointed out the role those agencies pay in the nation's economy.

"Nationally, non-profits provide 10 percent of America's work force, accounting for 13.5 million jobs," the release said. "Non-profits account for 5.4 percent of the (gross domestic product) and 9 percent of all wages paid."

McGovern said it is difficult to estimate how much the tax deductions directly contribute to the donations Northern Berkshire United Way receives. But he said it is reasonable to infer that the deuductions help.

"When you look at some of our larger individuals who give gifts, we're talking about sizable gifts," he said. "That [tax change] would have an impact on them. They give more when they know they're going to get more back.

"But people in North County always amaze me. Even when times are tough, they still give in great amounts. I know it would have affected us, but I don't know if it would have affected us greatly."

That being the case, it may have made sense to make a major last-minute appeal to donors to get their contributions in before Jan. 1 in order to take advantage of tax laws before the "fiscal cliff" was reached.

But neither Berkshire Taconic nor Northern Berkshire United Way decided to go that route.

"We did not send out any specific communication [to donors] about the fiscal cliff," BTCF Marketing Director Kimberly Rock said on Wednesday. "We didn't want to get into any scare tactics. There wasn't anything concrete to talk about.

"But there was a chance [the deduction] was going to go away, which would not have been good."

Tags: Berkshire Taconic Community Foundation, Congress, donations, NBUW, non-profit,