Williamstown Planning Board Looks to Rezone Parts of Simonds Road

|

|

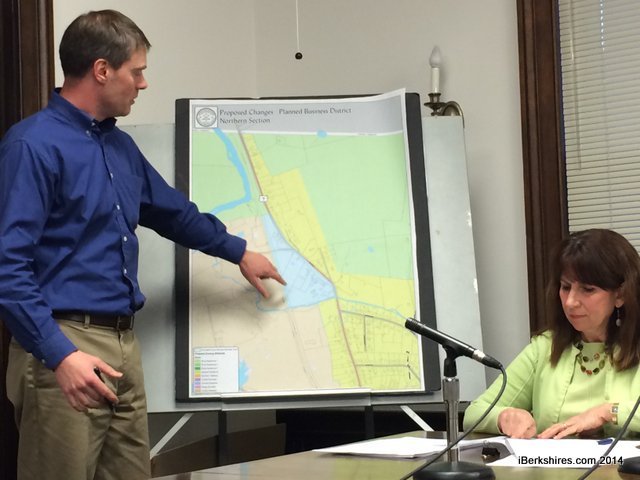

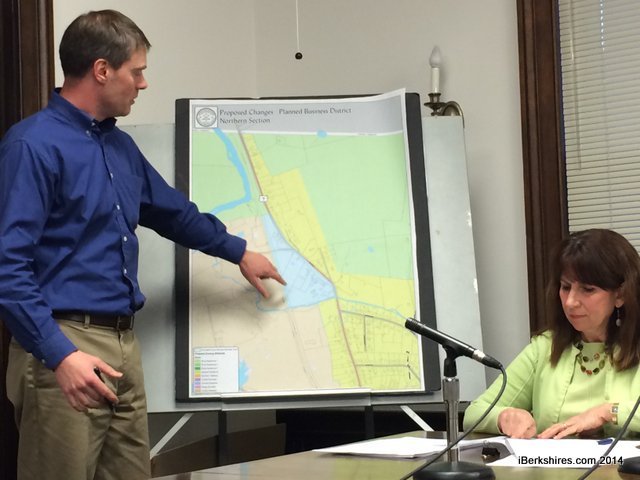

Above, Planning Board Chairman Chris Winters points out proposed zoning changes on the map. Left, Cozy Corner owner Bhavin Shah wanted to be assured businesses detrimental to the area wouldn't be allowed. |

WILLIAMSTOWN, Mass. — Residents will be asked at the annual town meeting whether they want to expand Williamstown's Planned Business district along a stretch of Route 7 near the Vermont state line.

The Planning Board on Tuesday recommended three zoning bylaw amendments to May's town meeting.

Among the proposals is one that would rezone parcels immediately surrounding the intersection of Sand Springs Road and Simonds Road (Route 7) and an approximately 3-acre parcel further north near the Steinerfilm property.

All of the land in question is currently zoned General Residence, meaning that businesses currently at the corner of Simonds and Sand Springs Roads — the Cozy Corner restaurant and motel and the currently closed convenience store — are non-complying uses of the properties.

Both businesses are "grandfathered in," Planning Board member Patrick Dunlavey explained during a public hearing on the proposed changes.

"Already, these properties are being used for business," Dunlavey said. "I don't think anyone feels they should change from business to residential, and this gives the people who own the properties a little more leeway in terms of what they can do with the properties."

Cozy Corner owner Bhavin Shah was among the residents to address the board on the proposed changes. He asked if there was any conceivable downside for a business owner like himself to being moved to the Planned Business district and whether it would impact his property taxes.

Planning Board Chairman Chris Winters explained that the town has a unified tax rate, under which business and residential properties are taxed at the same rate, so there should be no tax impact.

Otherwise, it's all upside for the business owner.

"The benefit to businesses is, all of a sudden, it becomes something you do by right," Winters said. "Right now, if you closed the business for five years, that's it. It can never be anything but a residence.

"And if you decide, 'I don't want to be in the motel business. I want to be a bookstore owner,' now you would be able to."

Shah noted that in addition to being a business owner, he also is a resident of the town, and he wanted to make sure that no businesses would be allowed in the area that would be detrimental to the neighborhood.

That same concern was voiced by Simonds Road resident Richard Daniels, who lives next to Turner House, the veterans home across Simonds Road from the former convenience store.

"I think we have a lot of bad things in that area," said Daniels, who said Turner House is a model neighbor. "In the summer, if it gets a little humid, you don't want to be living there and have your windows open. The sewage treatment plant will choke you.

"We've got the dump down there, we've got the sewage treatment plant. We've got the town yard. ... We're concerned with what else might end up there."

Winters sought to reassure Daniels and other neighbors in the room that the town's Planned Business district is not a

free-for-all.

"I'm struck by how little we're allowing in what we're calling Planned Business without the owner coming before this board or the Zoning Board and making a pitch, which is another opportunity for the public to come in and comment," Winters said, referring to the "use chart" in the town's zoning bylaws.

"It's not some sort of carte blanche. ... Just the opposite. [The proposed bylaw change] is very incrementally allowing some business uses that are going on literally the next property over."

The Planned Business district, marked in blue, would expand into the outlined areas, which are to the north and west. The Planned Business district, marked in blue, would expand into the outlined areas, which are to the north and west. |

Realtor Paul Harsch commended the board for addressing the non-conforming property issue.

"It removes a hardship on business owners," Harsch said. "For example, the former convenience store property could look for a different use, which would be disallowed under current zoning.

"One of the concerns for this board is how can they fill empty spaces in town and improve the tax base rather than putting more of the burden on the homeowners. ... Anything we can do to make things a little easier on business owners is beneficial."

The Planning Board also recommended to town meeting a new business use in the town's modestly sized light industrial district.

Specifically, the planners recommended the town allow self-storage facilities in the district, which includes the Steinerfilm lot and a narrow stretch along the railroad tracks near Cole Avenue.

"We have none of these businesses in town, partly because we don't allow it in town," Winters said. "This article suggests that self-storage should be allowed, by right, in the limited industrial district."

The third article recommended by the planners for the annual town meeting ballot changes the town's Wireless Zoning Bylaw to bring it into compliance with a 2012 federal law that narrows the authority of communities to regulate modifications to existing cell towers.

All three articles were sent to Board of Selectmen, which finalizes the annual town meeting ballot. Each will require a two-thirds vote of the town for passage at the May 20 meeting.

Tags: bylaws, commercial zoning, town meeting 2014,

The Planned Business district, marked in blue, would expand into the outlined areas, which are to the north and west.

The Planned Business district, marked in blue, would expand into the outlined areas, which are to the north and west.