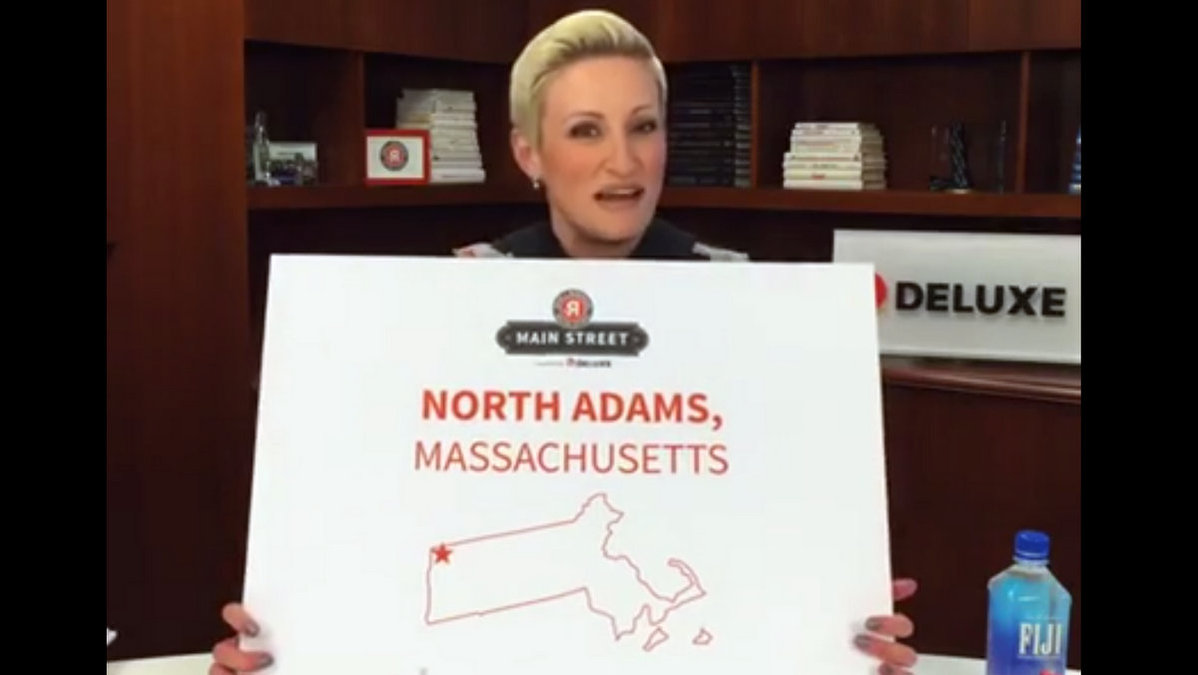

North Adams in First Round of Small Business Revolution Challenge

NORTH ADAMS, Mass. — North Adams is the running for a $500,000 boost to benefit its downtown and small businesses.

The city is one of eight semi-finalists for the Small Business Revolution on Main Street challenge, selected from 14,000 entries.

The challenge is sponsored by Minnesota-based Deluxe Corp., which has been providing small businesses with printing, design and now web publishing resources for a century. It services some 4.5 million small-business customers and more than 5,000 financial institutions.

The company marked its centennial anniversary in 2015 by going to small towns across the nation to share the stories of 100 local businesses that "represent the best of the American entrepreneurial spirit." That continued with a challenge to boost a small-town main street and its businesses.

The result was this year's Small Business Revolution eight-part documentary series of the $500,000 makeover of Wabash, Ind., with Deluxe's chief brand officer Amanda Brinkman and "Shark Tank's" Robert Herjavec.

Earlier this year, the company solicited nominations for another small town to receive the same benefits. On Tuesday, Brinkman announced the semi-finalists on Facebook Live, with North Adams coming in as the eighth and final nominee.

Also nominated was Red Wing, Minn.; Marietta, Ohio; Woodland Park, Colo.; Georgetown, S.C.; Frostburg, Md.; Bristol Borough, Pa., and Kingsburg, Calif.

Brinkman said the SBR crew will be visiting the eight sem-finalists to determine which would be most helped by their time and funds. On Feb. 9, four to six finalists will be revealed and online voting will take place over one week to choose the winner.

"We were overwhelmed by the response and we were so excited to see that we were trying to do here is really resonating with you," Brinkman said in the video. "You love your small businesses, you love your small towns. So do we."

Tags: contest, documentary, small business,