| Home | About | Archives | RSS Feed |

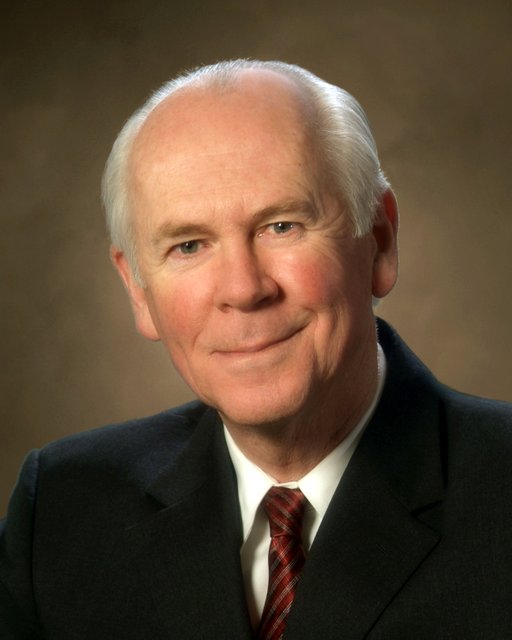

MountainOne's Crowe Announces Retirement

Stephen G. Crowe will retire as CEO of the MountainOne holding company on Dec. 31. |

According to the plan, Crowe will retire from MountainOne effective Dec. 31, 2012, and an announcement regarding the next leader for MountainOne is expected in the coming weeks. Crowe will remain with the organization following his retirement, serving as a Trustee of MountainOne and a director of Hoosac Bank.

Dan Bosley, chairman of the MountainOne Board of Trustees, said: "Steve began as CEO of Williamstown Savings Bank and he will soon retire as CEO of the MountainOne holding company that now includes Williamstown Savings as one of its subsidiaries. Steve's conception and development of MountainOne Financial Partners was a monumental undertaking, and few understand the countless regulatory hurdles he worked through over the course of several years in order to make this new and innovative company a reality. He is leaving very big shoes to fill."

"I consider the creation of MountainOne Financial Partners to be the pinnacle of my banking career, and I am proud that I was able to serve as the company's CEO for 10 years," Crowe said. "I look forward to my continued service as a Trustee of the company. And, I plan to continue my active role in national banking concerns, so that I can advocate for local community banks like ours."

When Crowe joined Williamstown Savings Bank as CEO in 1994, the bank had $65 million in assets. Today, the banks of the MountainOne holding company have combined assets of over $850 million. The market share for the banks in the communities they serve has also increased steadily during this same time period.

Crowe's 30-plus years of banking have been marked by innovation and a pioneering spirit. Upon joining Williamstown Savings Bank, he promptly put in place the well-received and successful Community Dividend Program. The CDP allows customers of the bank to annually select their favorite local charitable organization from a voting ballot. Funds are granted to each organization listed on the ballot based on the percentage of votes they receive. Williamstown Savings was the first bank in Massachusetts to establish such a guaranteed giving program. Since CDP voting first began in 1996, the program has awarded well over $1,000,000 to nearly 70 organizations that directly benefit local community residents.

Crowe's greatest achievement during his banking career was the development and implementation of the MountainOne Financial Partners holding company concept. The launch of MountainOne in 2002 created the first three-bank mutual holding company in the United States. The holding company concept allowed each subsidiary to maintain its own established name, offices, and management team, but also allowed the companies to pool resources and share common, and often burdensome, expenses such as technology and compliance. In 2002, the unusual MountainOne holding company concept was featured in Banker & Tradesman and in 2006, MountainOne was included in a Community Banker magazine article titled, "Innovative Mutual Institutions."

A Certified Public Accountant, Crowe's resume includes a host of national and community board leadership positions. He currently serves as treasurer of the American Bankers Association and also serves on the Board of Directors for the ABA's Education Foundation.

In the local community, Crowe serves as chairman of the Board of Trustees for Massachusetts College of Liberal Arts, and serves on the Boards of the Massachusetts Bankers Association, the Savings Bank Life Insurance Company, and the Federal Home Loan Bank of Boston. He is also past-chairman of Northern Berkshire Health Systems and formerly served on the Boards of the Depositor's Insurance Fund, the Savings Bank Employees Retirement Association, the Berkshire Chamber of Commerce, and Pine Cobble School.

In 2009, Crowe was honored with the Faith R. Scarborough Award by the town of Williamstown. This Community Service Award is presented annually at the town meeting to a recipient chosen on the basis of "demonstrated integrity, excellence and dedication in community service." Crowe lives in Williamstown with his wife, Linda, and has two children.

Berkshire Bank Branch Officer Completes Graduate School With Honors

|

“We are so proud of Heidi’s accomplishment," Tami Gunsch, senior vice president of retail banking, said. "She completed an intensive program designed to build upon her already well-established banking and leadership skills. All that she learned will enhance her professional career and benefit our customers.”

Stonier is an intensive three-year program for bank executives. Since its inception in 1935, more than 17,000 students have followed a curriculum of more than 45 courses and enjoyed networking opportunities with more than 400 fellow students. Between sessions, students keep up with trends by completing additional extension and online coursework. The program culminates with the Capstone Strategic Project, where students develop comprehensive business projects for their financial institutions.

Higgins joined Berkshire Bank in July 2011 following the bank’s partnership with Legacy Banks. She had been with Legacy since 2000, serving as both branch officer and marketing officer, previously working at Berkshire Federal Credit Union. She holds a B.S. in marketing from Bentley University.

She is a registered para planner and was selected as a Berkshire County Young Careerist by Berkshire Business and Professional Women in 2009. She also serves on the Board of Directors of the Berkshire County Chapter of Business and Professional Women as well as Pittsfield Citizen Scholarship.

Berkshire Bank To Acquire Beacon Federal

|

Beacon is headquartered in East Syracuse, N.Y., and operates seven full-service offices with deposits totaling $677 million at March 31. The majority of its business is concentrated in the Syracuse market, as well as the Rome/Utica market which Berkshire entered last year with the acquisition of Rome Bancorp. When the merger is completed, Berkshire will have a total of 10 branches serving these markets, with approximately $700 million in deposits and third position in market share among regional banks. Additionally, Berkshire will add Beacon's Chelmsford office located north of Boston, which will be Berkshire's first Eastern Massachusetts full-service branch office, complementing the 10 residential and commercial lending offices that Berkshire presently operates in central/eastern Massachusetts.

Under the terms of the merger agreement, 50 percent of the outstanding Beacon shares will be exchanged for Berkshire shares at a fixed exchange ratio of 0.92 shares for each Beacon share, while the remaining 50 percent of Beacon shares will be exchanged for cash in the amount of $20.50 per share.

The transaction is valued at $20.35 per Beacon share, based on the $21.96 Berkshire closing stock

price on May 30. This represents 111 percent of Beacon's tangible book value per share and a

3.4 percent premium to core deposits based on financial information for the period ended March 31.

"We are very pleased to extend our presence in Central New York in this partnership with Beacon," Michael P. Daly, Berkshire's president and chief executive officer, said. "Our New York expansion last year exceeded our expectations in terms of financial return, customer retention, and business development opportunities. I am confident that our Beacon partnership will also prove to be a solid success for all of our constituencies."

Each Beacon shareholder will have the right to elect the form of consideration, subject to proration procedures to maintain the overall 50/50 mix of stock and cash consideration. The transaction is intended to qualify as a reorganization for federal income tax purposes, and as a result, the shares of Beacon common stock exchanged for shares of Berkshire common stock are expected to be transferred on a tax-free basis. The definitive agreement has been approved by the unanimous vote of the board of directors of both Berkshire and Beacon. Consummation of the agreement is subject to the approval of Beacon's shareholders, as well as state and federal regulatory agencies.

The merger is expected to be completed in the fourth quarter of 2012. One Beacon director will be appointed to Berkshire's board of directors. Berkshire anticipates that it will divest Beacon's modest-sized Tennessee operations in conjunction with the consummation of this merger.

Berkshire Bank Buys Mortgage Corporation

|

As the part of this transaction, Berkshire will maintain Greenpark's entire mortgage lending team in Needham along with its two founders, Paul Gershkowitz and Patty O'Meara, who will continue to provide leadership as first vice presidents of Berkshire Bank.

Michael P. Daly, Berkshire's president and chief executive officer stated,

"We are so pleased to bring the well-regarded Greenpark team into the Berkshire Bank family," said Berkshire President and CEO Michael P. Daly. "This partnership enhances our residential lending capabilities and our efforts to expand our reach into eastern Massachusetts. We look forward to carrying on the solid practices, processes and customer service of Greenpark Mortgage, which have made them so successful and which complement well our culture of community mortgage lending."

Greenpark will operate as the Greenpark Mortgage Division of Berkshire Bank and will continue to serve as the home mortgage company of the Massachusetts Teachers Association. Greenpark was established in 2001 in Needham and now also operates offices in Quincy, Cambridge, Methuen, Tewksbury, Andover and Westborough. Its mortgage professionals are licensed in the New England states and Mississippi.

This is the latest acquisition of Berkshire Hills Bancorp., which added Rome Savings Bank of New York and Legacy Banks last year and Connecticut Bank & Trust last month. Berkshire Bank is the largest financial institution in Berkshire County.

Berkshire Hills Bancorp Inc. Acquires CBT

Michael P. Daly

|

PITTSFIELD, Mass. — Berkshire Hills Bancorp, Inc., the parent company of Berkshire Bank, completed its acquisition of CBT – The Connecticut Bank and Trust Company, a $280 million bank with eight banking offices serving the Greater Hartford area.

CBT has been merged into Berkshire Bank, and the Connecticut offices will operate under the name Berkshire Bank – CBT Region.

"We are delighted to welcome the CBT team to the Berkshire Bank family, and we look forward to building on the strong foundation that they have established in Connecticut," Berkshire President and CEO Michael P. Daly said.

Berkshire Bank will maintain CBT's visual identity as well as its name. Additionally, David Lentini, former CBT chairman and chief executive officer, has transitioned to Berkshire Bank as Connecticut regional leader.

Connecticut Bank and Trust has operated branch offices in Glastonbury, Newington, Rocky Hill, Vernon, West Hartford, Windsor and Hartford. These branches will now operate as Berkshire Bank – CBT Region with full systems conversion occurring later this year.