| Home | About | Archives | RSS Feed |

The Independent Investor: The Bots Are Coming

|

One no longer needs to imagine a post-apocalyptic world where humans are hunted into extinction by intelligent robots. While a shooting war may not break out between the two sides before 2030, a new study by the McKinsey Global Institute indicates that as many as 375 million human workers will be replaced by automation.

Most readers are already aware that companies using high degrees of automation, such as Amazon, are decimating the brick and mortar method of selling products. Most analysts believe it is inevitable that this trend will extend to all kinds of products. Pharmaceuticals and food are just the most recent items to be transitioned over to the internet. While this will add convenience, lower prices, and speedy delivery to consumers, it comes at a cost. That cost is in the loss of jobs.

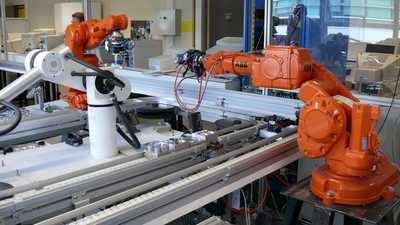

This new study by the McKinsey Global Institute predicts that this trend will continue. Jobs most at risk will be those that require physical activity. Everything from lathes to tractors will become automated, putting most machinery operators out of work. But it doesn't stop there.

Fast food services of all kinds will no longer need human help. Bank tellers, data collection and all types of processing services will also succumb to automation. Humans involved in back-office processing throughout myriads of industries will no longer be needed. Nor will many financial occupations from mortgage origination, paralegals to maybe even elements of money management.

Many of those developments are already happening, but the pace of change will accelerate. One can only imagine the consequences worldwide if workers simply do nothing but await their fate. What will be necessary, according to the study, is for both the private and public sector to embark on an enormous and lengthy program of re-training. It will require decades to transition those vulnerable workers, to teach them new skills in order to land tomorrow's jobs.

In an ironic twist of fate, some professions that have been scoffed at for decades could turn out to be the most lucrative job opportunities down the road. While many of my clients wring their hands over the high cost of a college education for their children, some are starting to wonder if a college degree is really worth the cost. Vocational schools are far cheaper and the starting salaries for many grads outstrip those with a college degree (depending on the major).

Most of us are already aware that the demand for some professional services is outstripping supply. Just try and find an electrician who can show up when you need one. Trades like plumbing, carpentry, landscaping and those that provide elder and child-care, among others, are already in high demand. The McKinsey study believes that will continue. Wouldn't it be something if, at some point in the future, plumbers will earn more than money managers or lawyers?

Some skills, such as managing people, those skilled in social interactions, professional sales or applying a specific expertise will probably never be replaced by robots. But that does not mean that those workers can rest on their laurels. The days when you could get out of school, enter the work force and never look back are already over.

If you are like me, you spend a good portion of your year attending various continuing education courses just to keep up with the changes in your profession. Just a week ago, as an example, our entire company spent the week in Chicago attending various courses on investment, estate planning, financial planning and more.

The fact that this trend is already spreading throughout this country should not be lost on any of us. Today, there are hundreds of thousands of jobs that remain vacant simply because there are no skilled workers to fill them. In order for this to change, a concerted effort by both corporations and the government must be put into place. Is anyone listening?

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $200 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.