Adams Set Fiscal 2014 Tax Rates

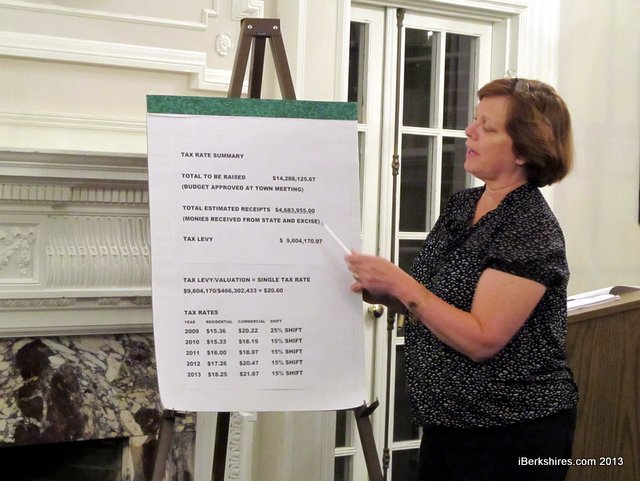

Assessor Donna MacDonald detailed the options the Selectmen have in choosing the percentage splits between commercial and residential properties. Assessor Donna MacDonald detailed the options the Selectmen have in choosing the percentage splits between commercial and residential properties. |

ADAMS, Mass. — The Selectmen opted to stay with a 15 percent shift in the tax levy to the commercial side, which sets the tax rates for fiscal 2014 at $19.95 for residential and $23.69 for commercial.

The rate jumps by $1.70 per $1,000 of assessed value of a residential property and $2.02 for commercial.

Last year's tax rates were $18.25 for residential and $21.67 for commercial.

While the Selectmen on Wednesday voted only on how to split up how the $9.6 million tax levy is raised, board members were met with pleas to find ways to lower the overall tax levy in the future.

"The real bottom line to all of the numbers we are talking about and percentages is that it hits homes. It hits the pockets," said George Haddad, a former selectman. "We can't always have what we want and sometimes we have to tighten the belt a little longer."

Chairman John Duval said the town has become more fiscally responsible in recent years and that this year's rate increase was mostly caused by the school district.

"The operational budget of the town did not increase in this current budget. It decreased," he said but added that the town still provides "excellent" services. "We want all of these things. It costs money to do all of these things."

The bond for the renovation of Hoosac Valley High School is responsble for 50 cents of the increase while the Adams-Cheshire Regional School District's budget — which included the reduction of staff positions — added another dollar, he said. The town is responsible for the remaining 20 cents, which Duval said was contractual and insurance increases.

Town Administrator Jonathan Butler said that in recent years, the town has cut three police position, four from the Department of Public Works, six from the Clerical Union, reduced the animal control officer to part time and consolidated other departments to save money.

Meanwhile, he added, the town has been successful in reeling in grants to help with capital projects. The goal is to be both progressive in attracting businesses while being fiscally smart, he said.

But those changes haven't been enough, according to Jeffrey Lefebvre. The town meeting member said the town's per capita income is one of the lowest in the county while the tax rate is one of the highest. The town needs to increase the tax base with new business or reduce services because as it is now, the tax increases are driving families out of town or causing more blight, he said.

"I look at what the people can pay," Lefebvre said. "We're supplying more and we have a smaller piece of the pie."

Duval compared the average Adams tax bill to other communities, a statistic some town officials believe is a better comparsion than rates.

In Dalton, the average property assessment is $201,558 with a bill of $3,652 and the city of Pittsfield's average assessment is $177,558 accounting for an average tax bill of $2,965. Both of which are higher than in Adams, which has an average assessment of $134,398 with a tax bill of $2,463, Duval said.

"A lot of this has to do with our assessments," Duval said.

According to Assessor Donna MacDonald, last year's reassessment dropped property values by nearly $30 million — causing the rate to rise to pay for the budget. MacDonald later added that the trend on property values has seemed promising in the last year.

Nonetheless, town meeting members approved the $14.2 million budget, which needs $9.6 million raised from taxes.

"I'm not for raising taxes but I am a realist in what needs to be done in this community," Selectman Joseph Nowak said.

The Selectmen said increasing the shift to lower the residential side would cause an even greater burden on businesses so the 15 percent shift is the middle ground.

"You are damned if you do, damned if you don't and you need to find a balance," Selectman Arthur "Skip" Harrington said. "For every 5 percent more we shift to commercial it is 20 cents lower for the residential but $1.03 for the businesses."

He added that 80 percent of the properties are residential so changing the shift hits businesses even harder.

"When you add a dollar to the business, it is not a $200 hit. It is more like a $2,000 hit and that makes a big difference in your business."

Tags: property taxes, tax classification,