Hancock Suing Berkshire Wind Over PILOT Payments

The town of Hancock and the owner of Berkshire Wind are in a dispute over PILOT payments. The Selectmen on Tuesday voted to take the utility to court. The town of Hancock and the owner of Berkshire Wind are in a dispute over PILOT payments. The Selectmen on Tuesday voted to take the utility to court. |

HANCOCK, Mass. — The Board of Selectmen on Tuesday decided to authorize the town's attorney to sue Berkshire Wind Power Cooperative Corp. for back payments from the utility's wind turbine farm on Brodie Mountain.

The action is the latest step in a dispute that stretches back to 2013, the last year of a three-year payment in lieu of taxes (PILOT) agreement between the town and the eastern Massachusetts power cooperative.

On Tuesday afternoon, the utility said it has been negotiating with the town in good faith and was disappointed by the board's noontime decision.

"Litigation will increase costs unnecessarily for the town and BWPCC," the utility wrote in a statement.

In addition to authorizing the legal proceedings, the Selectmen voted to return a $147,000 check the town received on Tuesday morning from BWPCC.

The town maintains that the company owes $165,850 to cover its payment for 2014 plus interest.

That is based on the $156,600 annual PILOT program that BWPCC and the town negotiated in 2011, an agreement that ran out after 2013.

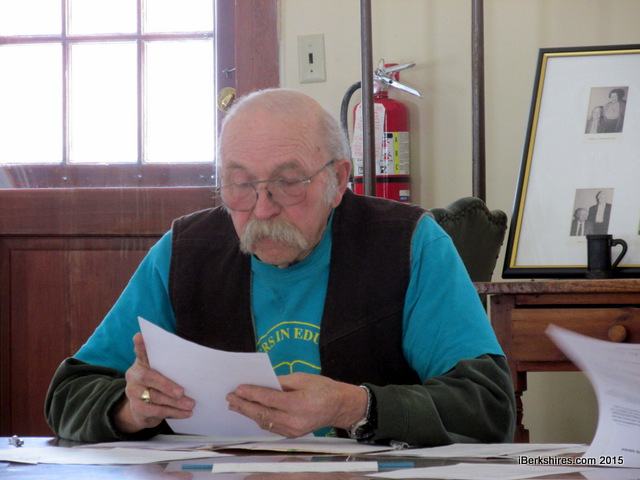

Chairman Sherman Derby said on Tuesday the town has been attempting to negotiate a new PILOT since 2013 but has gotten nowhere with the utility.

"We made offers to extend the contract at the same rate," he said. "They rejected the offer. They came back with an offer of a lot less, $100,000. We elected not to accept that.

"They came back with $120,000. We also refused that.

"The last thing we heard was on Feb. 3. Their offer was $150,000 for the delinquent year (2014), $147,000 in 2015, $145,000 in 2016 and $143,000 in 2017. We took that up at the meeting and rejected that."

In an email on Tuesday, the Ludlow-based municipal utility said the $147,000 payment was an interim payment because no new agreement is in place to cover 2014 and beyond.

"BWPCC has been in discussion with Town of Hancock officials regarding a new PILOT agreement since fall 2014," the company's statement reads. "With these discussions continuing into 2015, in February BWPCC issued a payment to the Town of $147,000 as an interim PILOT payment that would be adjusted, up or down, based upon the appraised value in the appraisal report resulting from the RFP or the amount agreed to by the Town and the BWPCC (without a new appraisal) in a new PILOT agreement."

The original PILOT was based on the $55 million value of the turbines, Derby said. BWPCC leases the land, and the town has no issue with the landowner.

The $156,600 annual fee was calculated by applying the town's current property tax rate, which, Derby pointed out, is the lowest in the commonwealth at $2.48 per $1,000.

Derby said that while it is true personal property — like the turbines — depreciate, the utility is generating more power from the 10 turbines than it projected before they were built and if it agreed to another three-year PILOT, it would be able to lock in the current tax rate.

"Do you think Hancock's tax rate is going to be $2.48 three years from now?" Derby said. "They're getting the benefit of that rate for three years. That would make up any depreciation they got."

Derby said the town attempted to have an appraisal of the turbines performed as part of the new PILOT negotiation. But he said it was BWPCC that stalled that effort.

"We had a response back [from the RFP], and the response was they want a minimum of $50,000 to $60,000 plus expenses to do the valuation," Derby said. "We gave that information to [BWPCC], and they were not willing to accept it. And this was from one of the vendors they gave us."

According to the 2011 PILOT agreement, the utility pays the for appraisal report.

Additional information:

The board also voted to retain the services of a prominent attorney who specializes in energy issues to represent the town.

Vincent DeVito of Bowditch & Dewey of Boston will assist town counsel in its action against BWPCC.

DeVito is a former U.S. assistant secretary of energy for policy and international affairs.

DeVito is described as "a corporate and regulatory attorney who represents utilities, corporations, investors, and entrepreneurs in the energy, power generation, and technology sectors in the United States and abroad," the website of Boditch & Dewey, where DeVito is a partner.

Tags: lawsuit, PILOT, wind turbines,