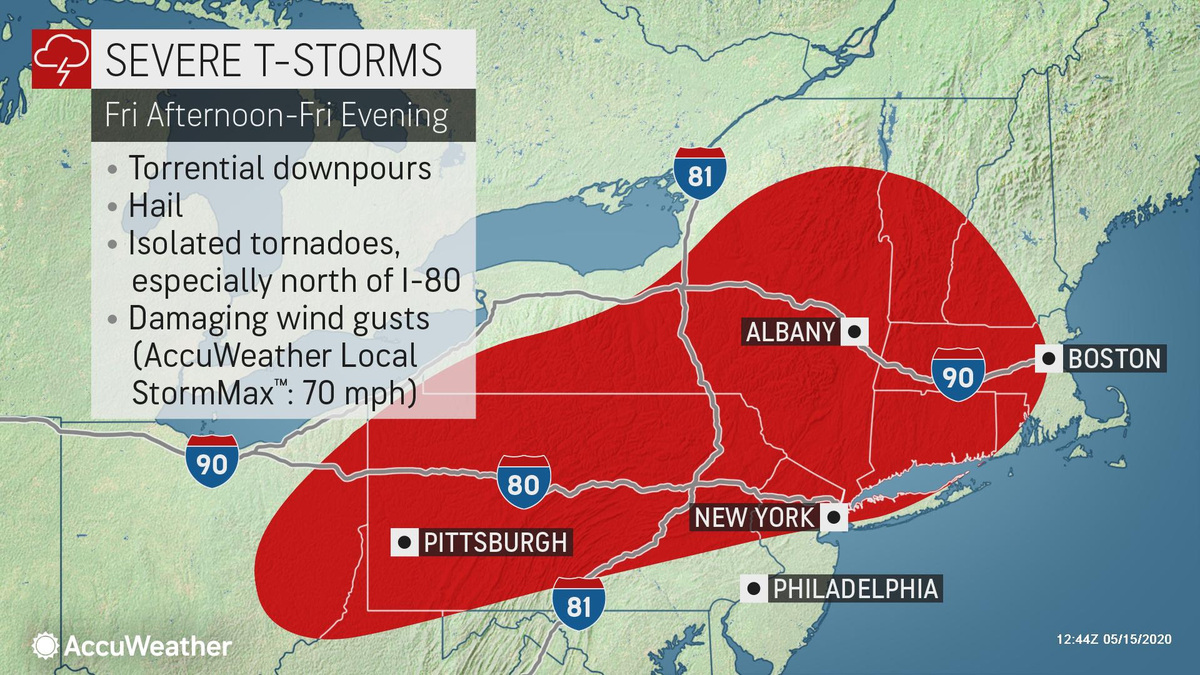

Severe T-Storms, Damaging Winds Moving Through Berkshires

One of the big weather stories on #Friday will be the #severe thunderstorm threat across the Northeast into the Ohio Valley, basically from Boston to Columbus. The main threat from these #thunderstorms will be damaging winds but hail and a tornado or two are also possible. pic.twitter.com/dSXdhQsw05

— National Weather Service (@NWS) May 14, 2020

Severe Storm Threat Continues.

— Steve Caporizzo (@SteveCaporizzo) May 15, 2020

Expected warm and humid air today....temps spiking 75 to 80 thus afternoon.

Clusters of cells may form 3 to 5pm....the main squall line 5 to 7pm....

Main threat damaging winds, some large hail in any discrete supercells, and a few rotating storms pic.twitter.com/MLHjxwxiYG

The line of organized T-Storms is predicted to hit central MA between 6 & 9 pm. CT between 8:30-11pm. Northern NJ between 9-11 pm. The line of storms weaken as they pass through CT & Lower Hudson Valley. pic.twitter.com/7i6JHB4brw

— New England Weather (@SouthernNewEng1) May 15, 2020

Risk for severe storms today as isolated T-storms develop initially between 4-8pm becoming more widespread from 8-11pm. Main concerns will be damaging wind gusts and hail, especially in western New England, where an isolated tornado cannot be ruled out. pic.twitter.com/UwZ1Q9VVBa

— Jason Doris (@Doris_Weather) May 15, 2020

Severe weather is possible across much of Southern New England tomorrow. Storms are expected to occur from the mid afternoon into the evening.

— Tucker Antico (@tuckerweather) May 14, 2020

PRIMARY THREAT: Damaging Wind

Secondary Threat: Isolated Tornadoes

Tertiary Threat: Large Hail pic.twitter.com/GFSzKPhMMq

Tags: bad weather, rain,