| Home | About | Archives | RSS Feed |

The Independent Investor: Hi Yo Silver

Gold is at record highs this year but silver is barely back to where it was 30 years ago. As the spin doctors out do each other in bumping up their price targets for the "other" metal, I am going to stick to my guns. Silver is just $6 an ounce short of my price target.

Gold is at record highs this year but silver is barely back to where it was 30 years ago. As the spin doctors out do each other in bumping up their price targets for the "other" metal, I am going to stick to my guns. Silver is just $6 an ounce short of my price target.

Back in 2008 when silver hit $20 an ounce and gold topped $1,000 for the first time, I recommended investors take profits. That turned out to be sage advice since both metals dropped precipitously. Silver fell to almost $9 an ounce. I promptly recommended purchasing it again. Once the price returned to $20 an ounce, I suggested that silver could reach $36-$37 before pulling back again. This week silver topped $30 an ounce before falling 5 percent.

There are several explanations for why silver has had such a great run this year. Silver's largest end-users are the electrical and electronic sectors. Both are now emerging from recession and industrial demand for the physical metal is rising. Jewelry demand for silver has also picked up. The price of gold has soared, making silver a less expensive alternative for shoppers.

The creation of silver exchange-traded funds (ETFs) has opened up a new source of demand for bullion as well. Up until 2006, investors interested in purchasing silver were required to buy and store bullion through a bullion desk, or go to a jeweler or trade in the futures market. The advent of silver ETFs greatly expanded the silver market and offers investors a low-cost, liquid way of investing. As more and more investors purchase these silver ETFs, the funds must buy up additional quantities of silver or silver stocks, sending prices up even further.

Silver does offer some protection against potential inflation as a physical and transferrable store of value. It is the same argument that is behind the price increases we have experienced for all commodities from gold to pork bellies.

Gold and silver pros often keep an eye on the price ratio between the two metals. Up until 2008, it typically required 55 ounces of silver to buy one ounce of gold. Today that ratio is roughly 47 ounces. Silver has been outperforming gold all year but historically, (over 10 years) when that ratio hits 40, silver starts to underperform gold.

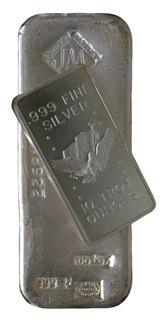

Like gold, silver can be purchased in a variety of forms. Some investors buy coins, others actually buy and store 100-ounce silver bars. These physical silver options trade at a premium to the silver price and storage costs eat into profits. One can also buy silver stocks, precious metals mutual funds and/or exchange traded funds that offer investors the option of stocks, futures or bullion without the storage fees or premiums.

Like gold, silver can be purchased in a variety of forms. Some investors buy coins, others actually buy and store 100-ounce silver bars. These physical silver options trade at a premium to the silver price and storage costs eat into profits. One can also buy silver stocks, precious metals mutual funds and/or exchange traded funds that offer investors the option of stocks, futures or bullion without the storage fees or premiums.

There is also the junk silver market: U.S. quarters, dimes and half-dollars minted before 1965. These coins have no collectable value since they are worn, scratched, chipped and otherwise damaged. This wear and tear has reduced their silver content. On average, they now contain only 71.5 ounces of silver down from the 90 percent when first minted. These old coins are sold in bags of either $100 or $1,000 face value and tend to outperform silver bullion.

Now you have a better idea of why silver is where it is. But remember, the most important lesson in investing in silver or any other commodity is to know when to sell. My price target remains $36-$37 an ounce. If I were a cautious investor, I would not wait until that price range is reached. Remember, too, that commodity prices can drop sharply and in a blink of an eye. A 10 to 20 percent drop in a week is entirely within reason, especially after a big run-up so buyers beware.

That doesn't mean that the bull market in silver is over but it could mean a sharp decline followed by a period of consolidation.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at 1-888-232-6072 (toll free) or e-mail him at wschmick@fairpoint.net. Visit www.afewdollarsmore.com for more of Bill's insights.

| Tags: metals, silver, ETF |