State Auditor Bump Calls for Change in PILOT Program

.JPG)

PLAINFIELD, Mass. — Western Massachusetts communities host a wealth of state-owned land but are not seeing proper compensation from the government for it.

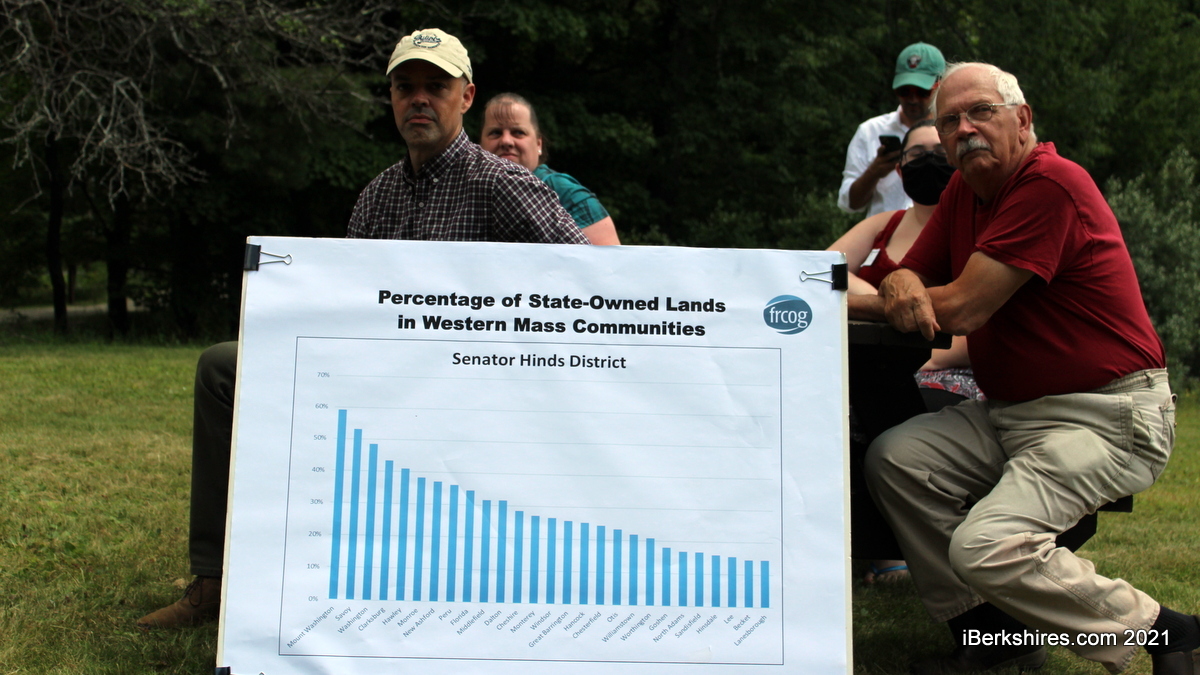

A 2020 report issued by State Auditor Suzanne Bump revealed that the commonwealth's payments in lieu of taxes (PILOT) program for state-owned lands (SOL) is underfunded and negatively affects smaller rural communities in Western Mass compared to larger, wealthier communities in the eastern part of the state.

On Friday, Bump joined state and local elected officials and stakeholders to tour two sites in Franklin County that demonstrate the disadvantaged effects of the program and begin a conversation that she hopes will spark change.

"It's scenic views like this and recreation resources like this that really constitute public good, they are the reason that so many people live here and travel here for recreation. but with the public good, there's a public cost that has to be borne," Bump said at the tour's second location, Dubuque State Forest.

"And in the estimation of my office, the Division of Local Mandates and the State Auditor's Office, although it doesn't technically constitute an unfunded mandate, it is nonetheless the state-imposed burden on municipalities to take lands off the tax rolls, and therefore to our way of thinking, the state needs to make good on its promises to reimburse communities who are losing that revenue.

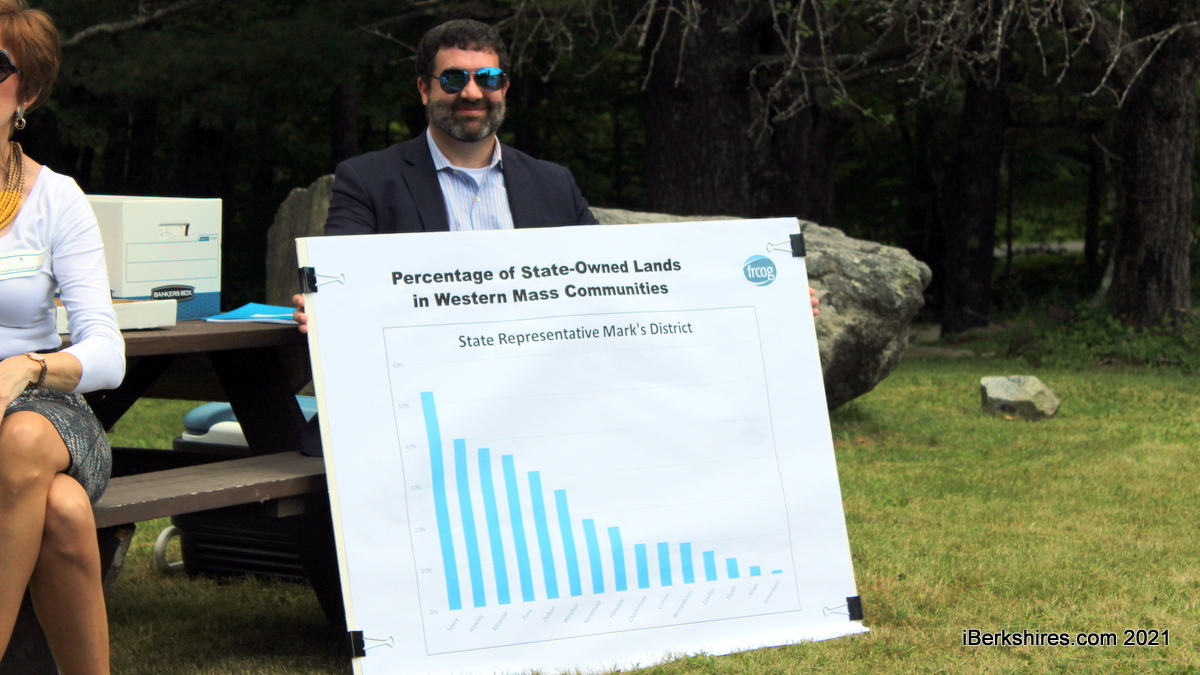

The tour began at Mount Sugarloaf State Reservation in South Deerfield with a roundtable discussion and ended in Plainfield. Officials in attendance included state Senator Adam Hinds, state Rep. Paul Mark, state Rep. Natalie Blais, and Franklin Regional Council of Governments Executive Director Linda Dunlavy.

Bump said the report conducted by her office showed the PILOT program's lack of funding but also indicated that smaller communities that aren't economically growing at the same rate as heavily populated eastern communities are being disadvantaged.

"The funding formula, not just the total appropriation, needs to be changed in order to make this more equitable," Bump said.

The Division of Local Mandates made several recommendations that aim to protect municipalities with reduced land and PILOT reimbursement values. These include increasing funding, using an aggregate tax rate method, and including a hold-harmless provision that protects areas with reduced land values.

Hinds and Mark, who represents communities in the Berkshires and Franklin County, seized that report and successfully began pushing their colleagues and the Legislature for better funding to disperse through appropriations.

In the Berkshires, for example, Mount Washington is 60 percent state-owned land and nearly half of Clarksburg is state forest.

Hinds said the two steps for solving this issue are getting the PILOT line item fully funded with up to $45 million and to re-assess the formula that disperses the funds.

"We were successful, again, thanks to the report that allows us to go to Ways and Means Committee and the House and Senate and say, 'Hey, we have a problem here, and to fully fund this line item, we need to move up to $45 million,' and there was an agreement to do it over three years, so $4 million this budget that was just signed by the governor, and then what the aim is for $5 million for the next two budgets," he added.

"The other piece is well, what about the formula itself and the team and the auditor really helped point out for us that 'look if we go back to an aggregate formula, we actually get $5 more per $1,000 of assessed value per acre,' and that's a big difference."

This bill is currently in front of the Joint Committee on Revenue that Hinds chairs. He said there may be a better way to address the issue overall and welcomed ideas that could maybe in integrated into the bill itself.

Mark believes in getting as much funding in the PILOT pot as possible.

If natural resources are something that state residents want to protect, he said, they have a role in making sure that they are contributing.

"It's a big issue for small towns like this, and the town I live in Peru, we've got sometimes close to 50 percent of the town is owned by the state," he explained.

"It's a noble goal, as a statewide policy, we want to encourage open space and protect these beautiful areas, but at the same time, these small towns with 350 people, they can't bear this burden completely on their own back, so trying to either reformulate this formula to make sure it is fairer and providing more adequate revenue to these small towns I think is really important."

John Follet of Chesterfield pointed out the environmental advantages of state land in relation to carbon sequestration from, or the removal of carbon dioxide from the atmosphere to slow or reverse climate change.

Chesterfield is 38 percent protected lands with 71 percent of that being owned by the state.

"When you talk about the land that's put in protections and its role in carbon storage and carbon sequestration, it's well known that well-managed forests are more likely to sequester and store carbon better than unmanaged forests," he said.

"So state-owned land tends to be better managed, and there's an advantage to having the state-owned land in terms of in terms of its ability to store carbon, so I think it is a dimension that really needs to be valued and compensated for."

Bump, who has had a home in Great Barrington, also spoke on another report her office is facilitating that looks at the deficiencies in public infrastructure around the more rural western end of the state. The report will look at roads, bridges, culverts, public safety facilities, fire stations, police stations, councils on aging, health departments, and similar facilities.

The auditor will not be seeking a fourth term in the 2022 election after a decade in office. Hinds and Mark thanked her for the work she has done and said they are sad to see her leave office.

"What we want to do with this conversation is in fact have been picked up by the media and for us to speak loud enough, so that the folks back in Boston hear," she said about the issues that were brought to light on Friday.

"So it's gonna take a lot of repetition for the folks at the other end of the state to get the message, that this is a problem that we need to solve as a commonwealth, and need to find ways to just create that momentum to move this set of ideas forward."

Tags: PILOT,