Truffles By Tarah Pop-Up Opens in Pittsfield

PITTSFIELD, Mass. — Tarah Warner hand rolls and dips as many as 1,000 truffles per week.

Throughout November and December, her treats will be available at a pop-up store in the downtown.

On Friday, the ribbon was cut for Truffles by Tarah at 48 North St. Offerings range from classic favorites such as dark chocolate to lavender lemonade.

"I'm just really excited to highlight locally sourced ingredients and to do the fun, interesting flavors that I've always been told nobody wants to try," Warner said.

"Things like the lavender lemonade, where people are like, 'No one's going to eat that, that's weird,' and then magic, people really like it, and now it's the holiday season so all those really fun winter flavors, the peppermint, the eggnog. It's really nice to be able to play with seasonal flavors and seasonal ingredients."

Born in raised in Berkshire County, Warner is a graduate of the Culinary Institute of America in Hyde Park, N.Y., with a degree in baking and pastry. She has worked at a chocolatier for 14 years, for some time at Mielke Confections in South County before it closed.

Her business is about two years old and before the pop-up, sold her treats at farmers and makers markets.

While chocolate can't be sourced from this region, Warner uses local ingredients when possible to flavor the truffles. Her first curated collection was a "Berkshire Box" that includes five truffles with locally sourced ingredients.

These include coffee from No. Six Depot and Baldwin Extracts in West Stockbridge.

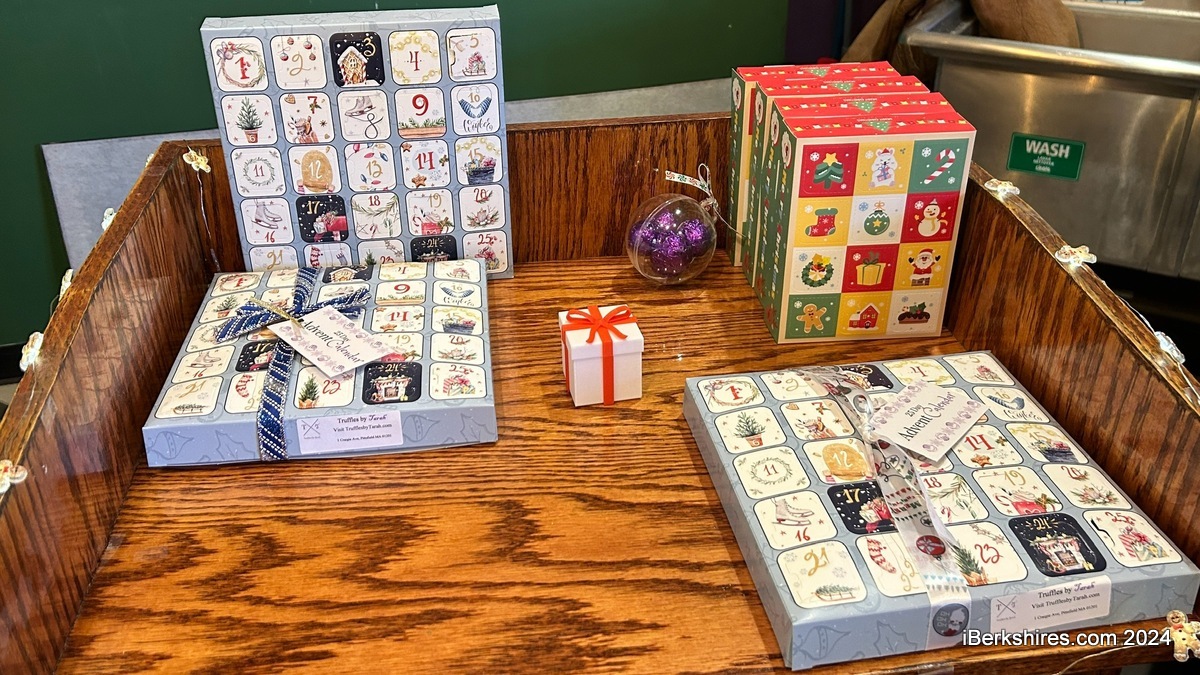

Because this is a holiday pop-up, the treats are in seasonal packaging. Warner's advent calendars, available in 12-day and 25-day options, have received a lot of attention.

She is a member of 1Berkshire, which provided the ribbon cutting, Downtown Pittsfield Inc., and a graduate of the Entrepreneurship for All program. Representatives from each organization, Mayor Peter Marchetti, and the city Office of Cultural Development were present at the event.

Warner said DPI Managing Director Rebecca Brien was instrumental in securing this storefront.

"All of DPI was a huge help with getting this to where it is," she said.

Because the storefront that formerly housed The Spot has ample space, a rotating schedule of other local businesses will appear at the pop-up. This past weekend and for one day in December, Natural Wallflower bath and body products will be at the shop.

Owner Rachel Donohue explained that her products are eco-friendly with no plastic packaging and made with plant-based and essential oils. Her most popular products are shower steamers, which come in eucalyptus, lavender, orange, and fir needle for the holidays.

Tags: chocolate, popup, ribbon cutting,