63-Year-Old Lost Postcard United With Intended Recipient

PITTSFIELD, Mass. — In 1961, a South Junior High student sent a postcard from Paris to her favorite art teacher. On Monday, he finally received the piece of mail.

Raymond Guidi was surprised and glad to see the communication after all of this time. He worked for the Pittsfield Public Schools for a few years and then taught in Dalton for nearly 40.

"I have had former students contact me through the years," he explained.

Two weeks ago, iBerkshires.com called on the public to locate "Mr. Guidi" after a long-lost postcard addressed to him from Sue Smart arrived at Herberg Middle School. Not long after being published, Guidi’s daughter contacted the school's clerk Dorothy McGurn and relayed that he was appreciative of the effort and would like the card as a keepsake.

"It feels awesome," McGurn said.

"It’s wonderful to know that we were able to connect him and hopefully we find Sue. That would be an even happier moment to reunite him with Sue and just it would come full circle with the end of the story."

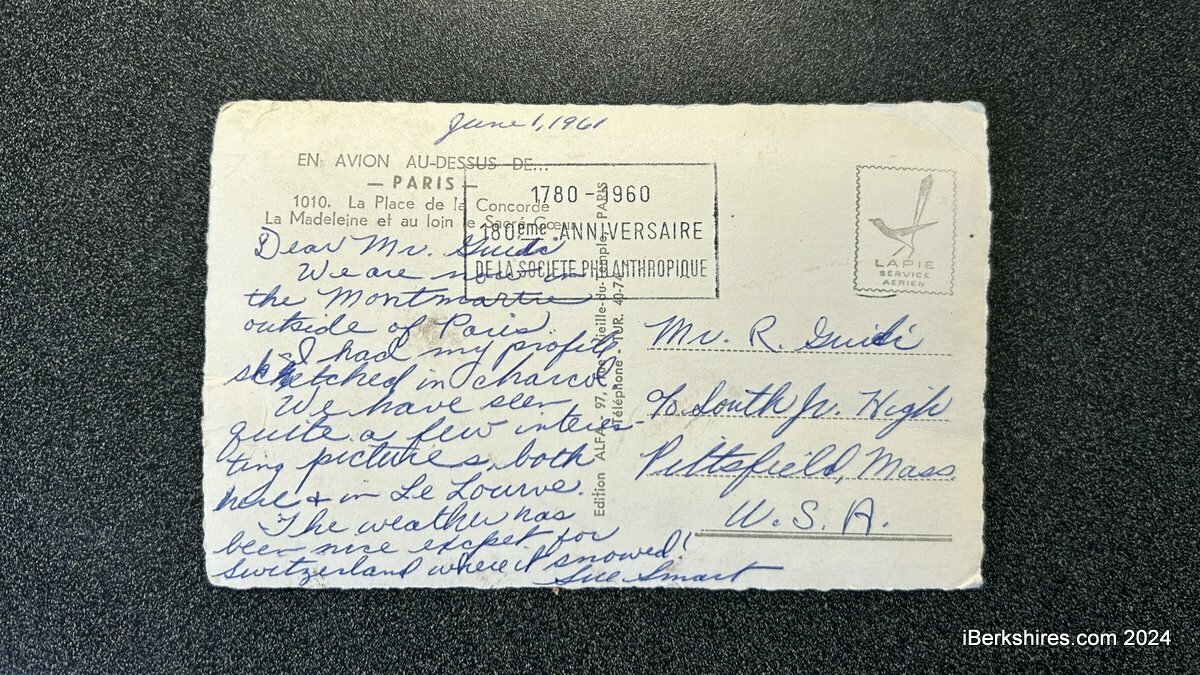

Dated June 1, 1961, the postcard reads:

Dear Mr. Guidi,

We are now in the Montmartre outside of Paris. I had my profile sketched in charcoal. We have seen quite a few interesting pictures both here and at Le Louvre. The weather has been nice except for Switzerland where it snowed!

Sue Smart

It was addressed to "Mr. R. Guidi, c/o South Jr. High, Pittsfield, Mass, U.S.A." Theodore Herberg Middle School formerly served Grades 7-9 as South Junior High School.

On the front is an image of Place de la Concorde, a public square located between the Arc de Triomphe and the Louvre museum.

McGurn said the Postal Service worker delivered it with an equal amount of confusion, as it just appeared in his delivery box that morning. It was speculated that it could have slid into a crevice for over a half-century and been discovered when a piece of machinery or old stock was moved.

Guidi was equally as amused by the discovery. He remembers Smart as a bright and talented student and had gotten another postcard from her in the past.

"Susan was actually there I believe my first year of teaching at what was South Junior High School," he recalled.

McGurn reported that in the search for Guidi, people shared fond memories of having him as a teacher and as a friend.

"From some of the messages I got from past students that had him or people who knew him, they said he was an awesome teacher and they had fond thoughts of and memories of him," she said.

The retired art teacher still exercises his creative talents through colorful, imaginative oil paintings. He showcased a variety of works that he has created through the years, adding that they are all for sale. A graduate of the former St. Joseph's High School in Pittsfield, he earned his fine arts and master's degrees from Syracuse (N.Y.) University.

McGurn was glad that she took the time to reach out to the press and figure out the mystery.

"I’m very surprised we found him," she said.

While Guidi was found, there's a search for Sue Smart, as it would be great for her former teacher to send her a postcard in return. Anyone with information on the sender can contact dmcgurn@pittsfield.net or bpolito@iberkshires.com.

Tags: good news, postcards,