Williams Donates Land for Housing Project

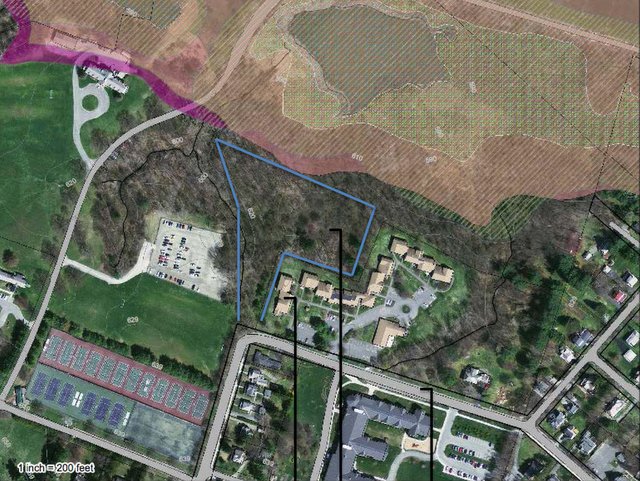

WILLIAMSTOWN, Mass. — Williams College President Adam Falk on Thursday announced the donation of "a little under" 4 acres of college land for an affordable housing project near the Proprietor's Field senior housing complex.

"This is really a marvelous day for the college and a marvelous day for the community," said Falk, who was joined at the podium by representatives of four non-profits who joined forces for a proposal to use the currently forested lot at the end of Southworth Street near the Torrence M. Hunt tennis courts.

Williamstown's Higher Ground, which was formed in 2011 to address the needs of Spruces Mobile Home Park residents displaced by Tropical Storm Irene, first approached the college about acquiring a parcel for some type of subsidized housing.

After determining the Southworth Street property was "uniquely suited for affordable housing," the college issued a request for proposals, and Higher Ground teamed up with Pittsfield's Berkshire Housing Development Corp., the Williamstown Elderly Housing Corp. and Boston's Women's Institute for Housing and Economic Development.

Berkshire Housing developed and manages Proprietor's Field, which is owned by Williamstown Elderly Housing.

College spokesman James Kolesar said Thursday more study needs to be done to determine how much of the donated parcel is buildable, and representatives from the non-profit partnership said it was too soon to say how many units the land could accommodate.

"The first thing is to get community input and get the engineering and analysis done," Berkshire Housing President Elton Ogden said.

Strictly speaking, the land still belongs to the college. It has signed an option agreement to donate the land on the condition it passes zoning requirements and the developers obtain the funding needed to develop it, Kolesar said. Without the signed option, Higher Ground and its partners would not be able to apply for regulatory permission or funding to pursue the project.

Falk elaborated on the reason why the parcel, known as Bluff Woods, is especially well suited for an affordable housing development.

"It not only abuts current affordable housing, but it is clean, in town, on a public bus route and near a senior center — for one set of potential residents — and across the street from the elementary school — for another," Falk said.

Ogden said it was unclear what mix of residents might be eligible for the new housing project, but both he and Falk referenced a housing needs assessment commissioned by the town's Affordable Housing Committee that addressed need among various demographic groups. (Both the report and summary can be found here.)

"Thanks in part to John Ryan's study, we have an idea where the need is," Ogden said. "In terms of what the mix is, we have to figure that out with input from the town."

Thursday's announcement was attended by several members of the town's Affordable Housing Committee and Long-Term Coordinating Committee, including Selectmen Chairwoman Jane Allen, who took the opportunity to pledge the town's support for the effort.

Likewise, Falk mentioned the donated parcel would only represent one piece of the puzzle in satisfying a need for affordable housing that both predated Irene and was exacerbated by it.

"[The donation] comes at a time of acute need for our community," Falk said. "This was the case before Tropical Storm Irene. ... On that one day, almost 5 percent of our town's non-student population lost their homes.

"We can as a community take satisfaction in the fact that — to complement the public efforts under way — we have taken, as of today, an important step toward addressing this communal need," Falk said.

Thursday was a time for rejoicing among those who have been invested in addressing the town's affordable housing needs.

Bilal Ansari, who serves as president of Higher Ground and as a member of the Affordable Housing Committee, delivered rousing remarks in which he indicated that the college's donation is an indication the town does not ignore "our neighbors in need."

"Today, we soberly celebrate and we gaily and publicly announce to our neighbors and to the world: We as citizens of Williamstown do not regard our 'Purple Mountain Privilege' as a perch to create further privilege, but it is rather a privilege that imposes on us and within us a responsibility to create an opportunity for all to live on higher ground," Ansari said.

Tags: affordable housing, senior housing, Williams College,