| Home | About | Archives | RSS Feed |

@theMarket: Market Gains Are Just Beginning

|

For those who have yet to commit to equity, it is time to reassess. We have entered a new phase in stock markets worldwide. It is called a secular bull market and could last for many years. Don't let this opportunity slip by.

Talking to prospective clients and investors over the last few years, I have heard a litany of reasons why stocks are not a good investment. The following are just a few of the more popular excuses: a second financial meltdown is just around the corner. The Fed's quantitative easing will spark hyperinflation. U.S. debt and deficits will sink the markets. Washington's politics will drive the country into a depression.

Then there are those trapped in self-fulfilling prophecies. I call them the "I missed it" crowd. These are the investors that continuously argued that the markets are too high year after year. Now, four years later and over 100 percent higher, they are still sticking to the same mantra. A subgroup of those dissenters, who are still holding U.S. Treasury bonds or CDs, would like to take the plunge, but they too are afraid that the stock markets gains are over.

My position is that the above investors are looking backward. Future gains will be equal to or better than those of the last few years driven by gathering strength in world economies and low interest rates.

So let's put this "markets are too expensive" argument to bed once and for all. The stock market, as represented by the benchmark S&P 500 Index, on March 24, 2000, was trading at 1,527. Today, Nov. 15, 2013, that level is 1,792. That is a gain of only 17.3 percent over 13 years (1.3 percent gain annually). That is much less than the inflation rate during the same time period and far below the market's historical average of 7 percent per year over the last 100 or so years.

Ask yourself if those kind of gains accurately reflect the advances we have witnessed over the last 13 years in education, energy, technology, science, medicine, food production industrial manufacturing and a host of other areas. By any stretch of the imagination, does a 1.3 percent gain in stock prices each year reflect those advances?

Of course not; but let's look at another metric, the trailing price/earnings ratio (P/E) of the market, a tool that attempts to value stocks by dividing the price of a stock by its past earnings. Back in March of 2000, the P/E ratio stood at 28.3 times earnings. Today, that ratio is only 17.4 times earnings. So why is the market cheaper now than it was 13 years ago?

The simple answer is that the stock market had been in a secular bear market for most of that time. During secular bear markets, which can last from five to 15 years, gains are hard to come by. During secular bull markets, which I believe we have now entered, the opposite occurs. There is a catch-up period where markets begin to make up for all those years of low growth. We are in that phase right now. In the years ahead, the gains will begin to slow down but should be above the historical average. We may even have a few years where we experience losses (because of a recession, for example) before growth resumes.

So for discussion's sake, let's guess that this particular secular bull market will last a decade. If the S&P 500 Index simply returns to its historical norm, that would mean 7 percent growth/year times 10 years or a total of 70 percent. Of course, if you compounded those gains the returns would be much higher.

The moral of this tale is that anyone with a long-term view could enter the market today, despite its historical highs, and expect to prosper for years to come. Sure, there would be pullbacks, as there are in every market environment, but the trend would be your friend. How simple is that?

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Food, the Next Scarce Commodity

Recently, a leaked report from a United Nations scientific panel had some bad news for the world and consumers in particular. The scientists are predicting that climate change, coupled with an increase in demand, have set food prices on an upward trajectory for decades to come.

Readers of this column should not be surprised. Over the last several years, I have written extensively on the subject of weather, climate change and the demographic shift to higher consumption of food within the emerging markets. We have all felt the impact in our pocketbooks every week at the supermarket. What is recent and most alarming in the panel's preliminary findings is the extent by which food production will shrink and demand rise.

Through this century, the United Nations Intergovernmental Panel on Climate Change, the world's foremost authority on the subject (and winner of the 2007 Nobel Peace Prize), expects food production will decline by 2 percent per decade. They blame climate change for the decline.

They forecast that higher temperatures because of greenhouse gases will reduce crop production in tropical climates while increasing production in cooler zones. Back in 2007, when the panel's last report was released, scientists believed that any reduction in production in the southern hemisphere would be nullified by increased production in the northern parts of the globe. That is no longer the case.

At the same time, consumption demand for food is predicted to rise by as much as 14 percent each decade. This increase in demand has two parts. The world population is expected to grow from 7.2 billion today to 9.6 billion souls by 2050. At the same time, the on-going change in the economic fortunes of those living in the lesser developed parts of the world will increase demand for the quantity and quality of all sorts of food.

Places like China, India and other emerging markets, where much of the world's population lives, have seen a drastic and welcome increase in living standards, wages and consumption habits. For the first time ever, peasants-turned-factory workers and shopkeepers can afford to enrich their diets with pork, beef, chicken and various dairy products. As salaries increase further, so will the demand for food.

Over the last few years, I have pointed out the impact of weather (drought, floods, hurricanes, etc.) in our own country on the prices of various food staples such as corn, wheat, sugar, beef and other commodities. Worldwide, we have witnessed huge spikes in all sorts of crop prices from coffee to cocoa. And don't forget that crop shortages and rising prices have already had an immediate and negative impact on the populations and politics of various countries.

Food riots in Haiti, Bangladesh and Egypt and in various countries in Southeast Asia have occurred with depressing frequency. Recently the scarcity of food has had regional implications, most notably in the Middle East. Discontent was as much about food as it was about autocratic rulers during the Arab Spring. In 2010, droughts in Russia, Ukraine, China and Argentina and torrential storms in Canada, Australia and Brazil — all major wheat and grain producers — considerably diminished global crops, driving commodity prices up. The Middle East was already dealing with internal social, economic and climatic tensions, and the 2010 global food crisis helped drive it over the edge.

The most obvious answer to combating this coming food scarcity is to bring more land into agricultural production. In my next column, we will take a look at what is happening in the United States in response to this challenge and what players will stand to benefit the most by this trend.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Lost Art of the Third Reich

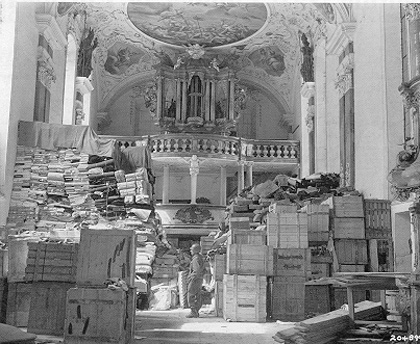

Gen. Eisenhower looks through a cache of stolen Nazi art; below, an American soldier in a church full of loot in Germany. Both images from the National Archives. Gen. Eisenhower looks through a cache of stolen Nazi art; below, an American soldier in a church full of loot in Germany. Both images from the National Archives. |

|

This week the art world is abuzz by the revelation that a $1.3 billion cache of 1,500 stolen artworks has surfaced in Munich. European investigators are hunting for yet a second treasure trove right now. It could be just the tip of the iceberg given the extent of Nazi looting during World War II.

Approximately 20 percent of the art in Europe was stolen by the Nazis in a determined and methodical campaign that stretched from 1937 to 1945. Through a series of German laws, the Nazis devised an art strategy intended to destabilize nonconforming cultures, especially the Jewish, which justified and regulated the legal confiscation of cultural and personal property.

The Nazis' first "purified" their own museums, galleries and private collections, establishing a standard for what was acceptable art. They defined "acceptable" as art that was essentially of Germanic origin, while labeling most modern art as "degenerate." Degenerate art of every kind was to be sold off, traded or tossed on massive bonfires at Third Reich rallies.

The Nazis exported that policy in their conquest of Europe. It was a deliberate attempt by Adolph Hitler, aided by Hermann Goering, an avid art collector, and Goebbels, Hitler's propaganda minister, to pillage the very best in what they deemed to be acceptable European art and historical artifacts (think "Raiders of the Lost Ark").

No sooner had Hitler's army crossed the border into Poland, for example, than the Einsatzstab Reichsleter Rosenberg (ERR) and Hitler's private art outfit, the Sounderauftrag, spread out conducting a systematic pillaging of 13,512 paintings and 1,379 sculptures in Warsaw alone. As the German war machine invaded and annexed country after country, Europe's art treasures flowed the other way in boxcars headed for German fortresses, castles and even underground mines and bunkers.

After Germany's defeat, the U.S. and British Monuments, Fine Arts and Archives section worked to uncover the sites where the Germans had hidden their plunder. Artworks of every conceivable form, value and size were unearthed in barns, railroad cars, in attics and even under mattresses. Hundreds of thousands of pieces, a truly priceless collection of cultural treasures, were recovered and returned to their rightful owners but much, much more has never been found.

This week's revelation of a cache of "degenerate" art confiscated from Jewish owners was actually discovered two years ago but German authorities sat on it "pending the completion of their investigation." Paintings by Picasso, Matisse and Chagall are among the collection that experts believe was part of the Nazi-confiscated art during the purification of German culture prior and during WW II.

The paintings were discovered stacked between dirty plates and cans of food in a decrepit apartment owned by the 80-year-old son of a museum curator-turned-art dealer who worked for the Nazis. The son, Cornelius Gurlitt, has disappeared without a trace. Authorities presume that there is a second cache of artworks. They believe it is a source of funds that Gurlitt has been selling off piecemeal and stashing the money in a Swiss bank account.

How much more of this plundered art exists and how much could it be worth? No one knows, but it could easily amount to more than the gross domestic product of several countries. Take the disappearance of the Amber Room as just one example. This famous room, located within Catherine the Great's summer palace, was one of the largest works of jeweled art ever made. An entire room lined with of tons of high-quality amber, accented with diamonds, emeralds, jade, onyx and rubies. During the war, it was dismantled, crated and shipped back to Germany where it was placed on display. British air attacks in 1945 forced the Nazis to once again dismantle and pack the room into 27 crates. It remains hidden to this day.

Rest assured these treasures are there to be discovered. Who knows, in the years to come, how many will be returned to us. And for everyone discovered, the world will be that much richer.

Editor's Note: For those interested in the subject, we highly recommend 1994's "The Rape of Europa: The Fate of Europe's Treasures in the Third Reich and the Second World War," by Lynn H. Nicholas. More locally, the late Williams College art professor S. Lane Faison was assigned to the OSS's Art Looting Investigation Unit and literally wrote the book on Hitler's stolen art, "Linz: Hitler's museum and library," which is available in the college's library.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: A Rough Rollout for Obamacare

|

Problems began on day one. Since then the controversy has escalated until just about everyone has something negative to say about the Affordable Care Act. Aside from the litany of computer glitches and misinformation that has greeted the uninsured millions who have attempted to access HealthCare.gov, there are now new questions arising over benefits and costs.

"My wife says her company's health insurance rep told employees that their premiums could go up by 35 percent next year because of Obamacare," claimed one client, who wanted to know if we should get out of the stock market before all hell broke loose.

I did some research and did find that for many of the estimated 150 million Americans who receive health care insurance as a fringe benefit may get hit with increased premiums in 2014. However, most increases will be in the 5-7 percent range (not 35 percent), which is about average since health-care costs increase by about 6 percent a year. The difference this year is that health insurance companies now have a new whipping boy to blame for these annual cost increases.

The companies are claiming that new fees and design changes to their existing plans as a result of Obamacare will cost employers and employees more than ever. How convenient, especially when none of these companies will go into detail about just how much Obamacare is costing them and us versus other reasons.

The truth is that worker contributions to health care insurance has risen by 89 percent over the last decade and employer costs have risen by 77 percent. Sure some of those increases can be laid at the doorstep of higher medical charges, but most of the increase simply reflects the fact that our workforce is getting older. The older we get, the more we need health services. Think about it, how much more time do you now spend in doctor's offices, visiting pharmacies or other medical centers. When we were younger, we paid insurance but rarely used the benefits. Now things are the other way around and hurting insurance company profit margins. Insurers don’t like it. Thus, the premium increases.

Another issue that is catching the American public by surprise is the cancellation letters many underinsured Americans are receiving from their health providers. Under Obamacare, you can still keep your old insurance as long as it provides at least minimum health care coverage. It turns out that many existing plans fail to pass muster when it comes to supplying benefits. Pundits are crying foul and blaming the Obama administration for "keeping this a secret" over the last three years. Hogwash!

The facts are that the Affordable Care Act had set a minimum level of health benefits for all Americans, which was spelled out and available for anyone who cared to check. That includes things such as emergency services, outpatient care, hospitalization, health care before and after the birth of a baby, prescription drugs, lab services, pediatric care, preventive and wellness and mental health and substance abuse services among others. If your former health insurer did not cover any of the above, ask yourself how valuable was it in the first place?

If your health care premiums need to go up because now you can go to the hospital to get your fingers sewn back on, or so you can deliver your next child, then so be it. If you genuinely don't have the money to make up the difference then the government will pay the difference under the health care act.

Amid the furor and increasingly-heated partisan debate, Republicans and even some Democrats are having second thoughts. So should we soldier through or just scrub it? Scrubbing it just returns the nation to the status quo. What's wrong with that, you may ask.

What many of us fail to realize is that taxpayers are already footing the bill for America's uninsured and under-insured. When someone with no insurance waits until their diabetes condition is life-threatening before seeking medical attention, who do you think pays for that limb amputation? When an elderly person fails to take their prescribed medication because they are underinsured, resulting in a heart attack or other critical malady, it is you, the taxpayer, who foots the bill for that hospital bed and all the other medical costs that goes with it.

As long as you and I are unwilling to allow fellow Americans to die on the streets, unassisted and unintended, we will continue to pay those costs one way or another — unless all Americans are insured and have a minimum level of health care. How hard is that to understand?

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Predicting the Next Stock Market Crash

|

As part of my job as a money manager, clients will often call or send me some doom and gloom report predicting the next financial meltdown. If I had a dollar for every time these author's predictions proved accurate, I might have just enough to buy a cup of coffee. Why then, do investors take them seriously?

The short answer is simple; the desire to know the future is a deep human psychic need. We Americans, as a country, are fairly gullible and a large number of us still believe divining the future is possible. In the case of finance, predicting the future can also mean the opportunity to gain (or lose) huge amounts of material wealth. Authors of these reports also know that fear and greed, along with the herd instinct, are the three main emotional motivators among stock market investors. If you couple those traits with just the right amount of sensationalism, you have a formula for an extremely effective sales pitch.

After all, the objective of these end-of-the-world reports is not to inform or educate, but to get the recipient to dip into their pocket and subscribe to an investment service, a newsletter or purchase of someone’s next book. The formula works so well that an entire industry has grown up around the concept. Today there are thousands of newsletters promising to unlock the future for you and me. It rarely works.

The news media often refers to this person or that person who "called the financial crash" or some other past market decline, but the evidence indicates otherwise. More often than not, that mythologized money manager or strategist may have voiced worry or concern over a specific issue — the housing market, easy lending, leveraged balance sheets — but not that the bond and stock markets would collapse as they did in 2008-2009.

In my own columns, for example, I voiced concerns back in 2007 and early 2008 that the stock markets were heading for trouble, but I never conceived of the extent of the problems or the magnitude of the declines. At most, I could and did correctly predict the short-term direction of the markets. Like everyone else, it was all I could do to keep up with the changing economic and political chaos as it unfolded.

No doubt someone got it right, but how useful is that? The laws of probability tell us that in a world where there are thousands of forecasts per day on everything from the weather to the number of new births in Bangladesh someone is bound to get a direct hit at some point. The question is whether that same person can do it consistently. The evidence says no. A lucky forecast by an individual or group on a specific event will be normally followed by a return to mediocrity (incorrect forecasts) in almost every case.

The forecasting track records for all kinds of experts are spectacularly poor no matter what the field. Despite all the advances in science, technology and computing, experts are no better at predication than they were in the days of Delphi. That's largely because modern science is proving that the deterministic view of the world, where the future is determined by a given set of rules and patterns, is naive. Rather, the future is fundamentally unpredictable and governed by the theories of chaos and complexity.

So the next time you receive one of these missives of misery my advice is to dump or delete it. The next crisis, whenever it occurs, will not be determined by events from our past. These writers usually rely on subjects that have already been discounted but are guaranteed to push your buttons. Things like the deficit, the debt level, the government (or lack thereof), hyperinflation or deflation, political chaos, the Chinese, the Middle East, oil, gold and the value of the dollar usually take center stage in their litany of reasons for the next Armageddon.

Remember this, it is not what we know, but what we don't know that will get us every time. If the writers truly know something we don't, why in the world would they need to write us for money?

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.