Clarksburg Selectmen, Finance Agree to Work Together

.JPG)

CLARKSBURG, Mass. — The new Finance Committee is determining the limits of its responsibilities and pledging to work hand in hand with the Selectmen on setting a budget.

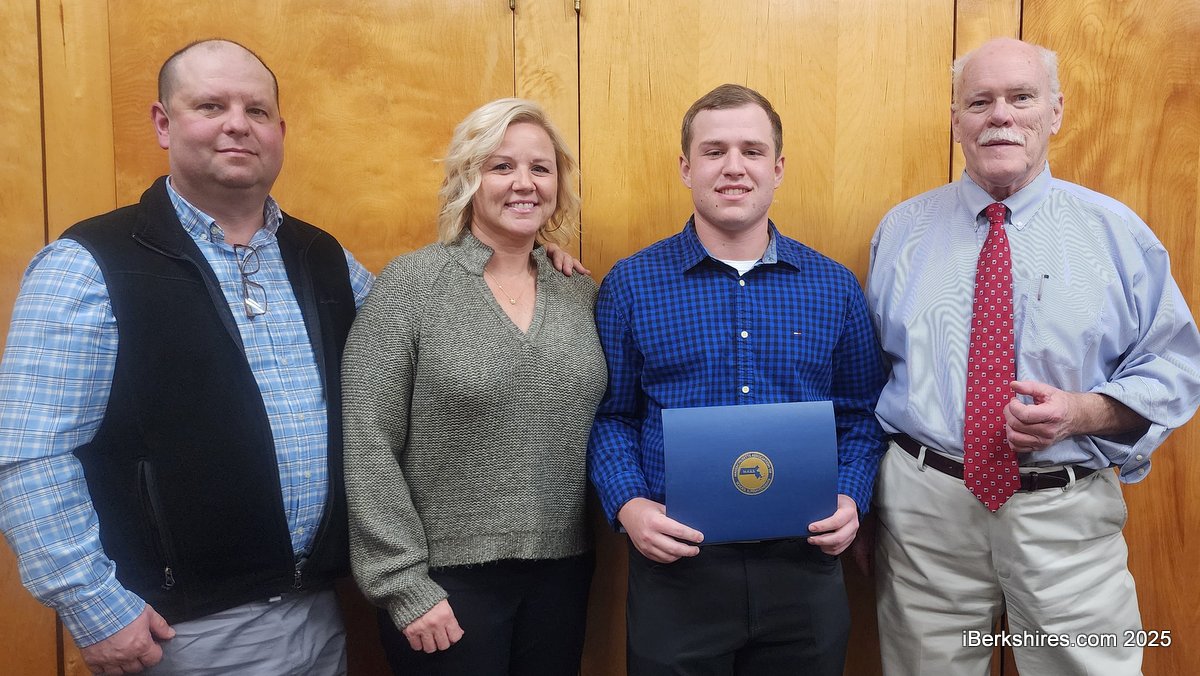

The new board of Mark Denault, Lori-Anne Aubin and Rebecca Buck were appointed by Town Moderator Bryan Tanner earlier this fall to replace committee members whose terms had been longer than the town's charter allowed.

Over the past couple months, the committee has held a number of organizational meetings to review the town's finances and the committee's own duties.

"There were things that came up that we wanted to clarify, at least our role and the role you expect from us," Denault told the Board of Selectmen on Wednesday after submitting a list of questions. "There's a bylaw with the town of Clarksburg that makes us a strong Finance Committee."

The boards had a wide-ranging conversation on the town's budgetary history and difficulties, with Chairman Carl McKinney explaining some of the particulars of certain line items, including the problematic gas inspector education payment of $293 that's coming out an account that does not yet exist. (The previous inspector's licensing had been covered by his full-time job.)

Denault said that was one of the questions that had arisen during his board's feeling out of what exactly fell under its purview.

"We're not trying to bring the town to a screeching halt, we want to be part of the solution," he said.

McKinney said the day-to-day financing operations of the town fell to the Selectmen, although he would welcome any input on process or questions from the Finance Committee. The committee is responsible for the Reserve Account (at about $10,000) and the formation of the annual budget, which it presents by warrant to town meeting.

"Twelve or 13 years ago, I was in your shoes, too. In a previous administration, it was the position at that time with that administrator that the Selectmen made the budget and shut the Finance Committee out of it," said McKinney. "It wasn't very good and it wasn't correct."

What it did was force the Finance Committee to hold separate meetings with the department heads and duplicate the efforts of the Selectmen.

"It seemed a terrible waste of time," said McKinney.

More recent boards have worked together with the Finance Committee in developing budgets. So far they've been in agreement, but that doesn't have to be the case. McKinney said the Finance Committee submits the budget but either board can add whether it recommends a particular spending item or not.

Denault said most of his committee's questions were answered, or rendered moot once it was stated that the Selectmen had control of day-to-day finances.

"It seems much clearer to me now what we're actually responsible for," he said. "The rest of this just falls into suggestions as far as other things I put on that list for you."

As for developing the budget, he thought department heads should also submit a "wish list" so both boards would have a better grasp of long-term needs: "It's great to level fund ... but it doesn't help for the future or the five-year plan."

McKinney agreed but noted the difficulties of the past few budgets.

"Ultimately, it's the voters who are going to decide what we to do ... They're the ones paying the bills, so it behooves us to do the best we can," said McKinney. "I look forward to working both with you folks and the administration and every town department to create a realistic and sustainable budget."

In other business:

• Town Administrator Thomas Webb said the culvert was in at the East Road bridge and the base coat of asphalt should be down by mid-December, with the finish coat done by next spring. A.J. Virgilio Construction of Westfield, which was awarded the Gates Avenue project, was doing test borings but it was expected the project may not be done until next spring.

• Board of Health member Paula Wells provided a revised contract for the Berkshire Health Alliance. The cost was reduced to $326, to $2,051 per year. Half of that is required by Dec. 31 to continue the contract through June 30. The board said it would try to find the money.

"No member of the Board of the Health has the expertise to deal with all of this," said Wells. "Just get me through until we go to the budget meetings. ... This is really important."

• The board approved the entertainment and alcohol license renewals for the Golden Eagle Restaurant and JT Golf Inc., doing business as North Adams Country Club.

• The overnight winter parking ban on all town roads begins Dec. 1.

• The board approved an increase in detail fees for police officers from $32 to $36 per hour and cruiser use from $10 to $18 to come into line with other communities and added a 10 percent administration fee to cover the cost of billing, collections, FICA (borne by the town and not the contractor) and insurance. Special town events would remain at $25 an hour.

Tags: board of health, bridge, Finance Committee,