Early Educators Learn Power of Play at MAAEYC Conference

PITTSFIELD, Mass. — More than 200 early childhood professionals gathered at Taconic High School on Monday for the Massachusetts Association for the Education of Young Children conference.

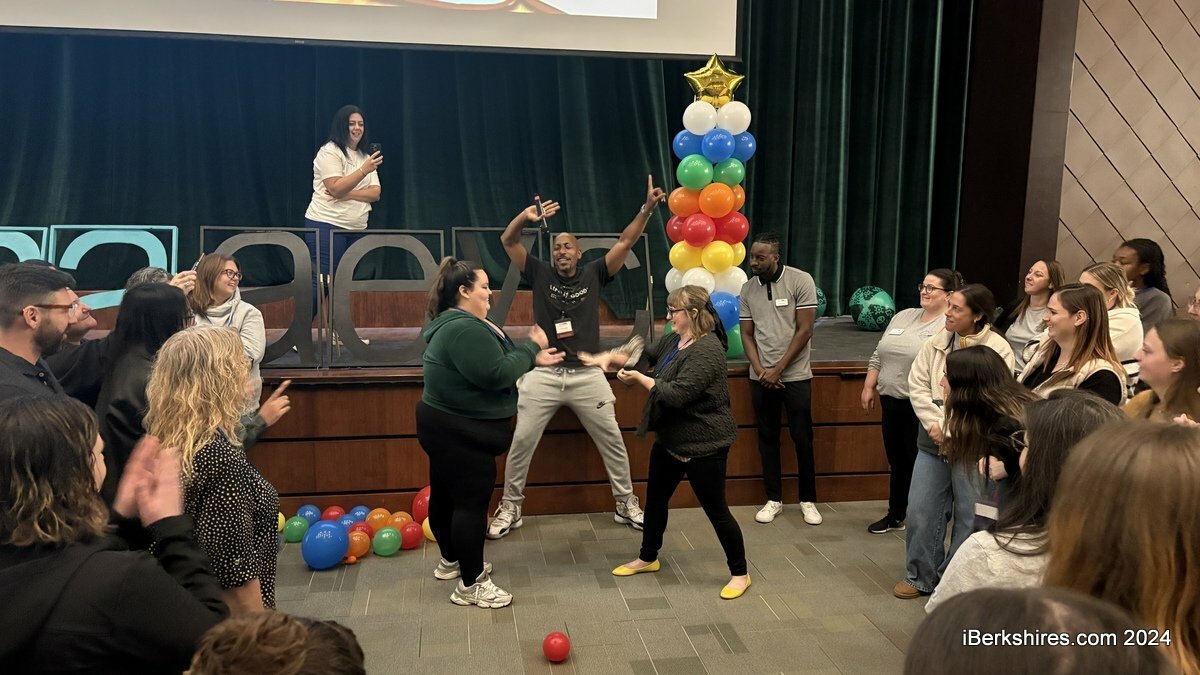

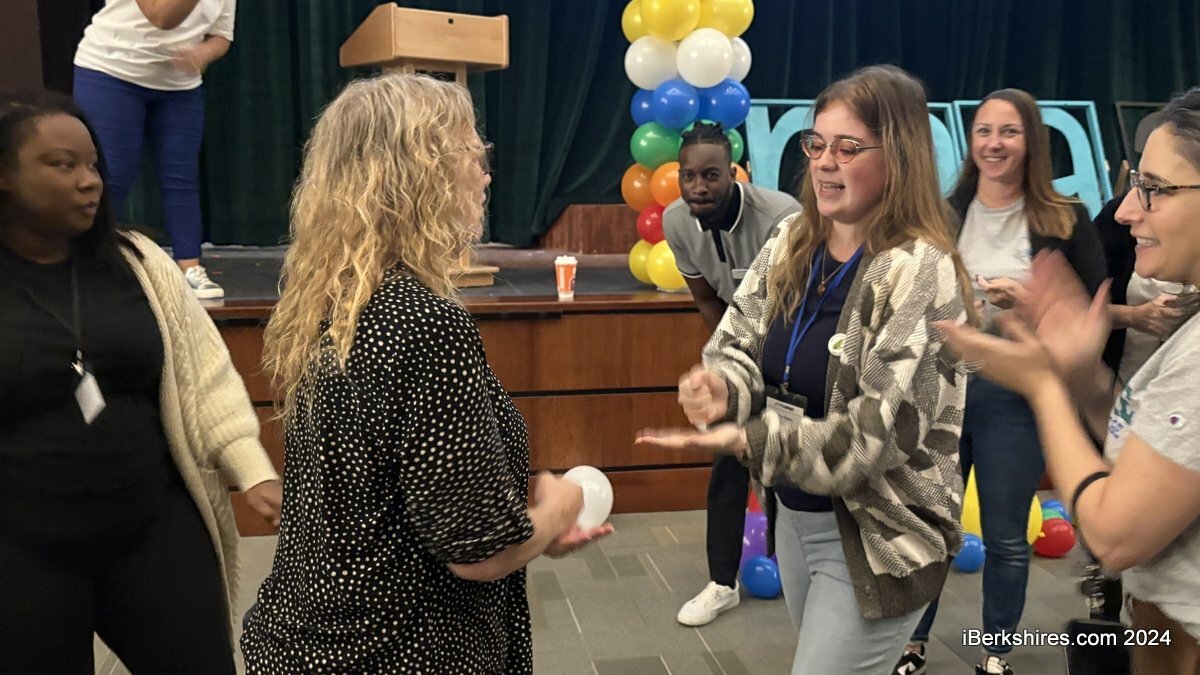

This is the second year it was held in Berkshire County though attendees were from throughout Western Mass. At one point, they were reminded of the power of play when the auditorium erupted into a rock-paper-scissors tournament.

Association President Cheryl Hovey said while the events of last week's election may have affected everyone differently, the MAAEYC is there to help navigate the next steps in times of uncertainty.

We find strength in community, she said, and Monday's event was a celebration of that strength because the work done in early childhood now more than ever has the power to shape the future.

"Today we gather not just to learn but to inspire and be inspired, to connect, and to celebrate the power of play and early childhood education," she said.

"… Play isn't just fun, it's the essential work of children. Through play, they explore, create, and learn, laying the foundation for lifelong learning. It's through these moments of wonder and discovery that we build positive behaviors and resilience of our young learners."

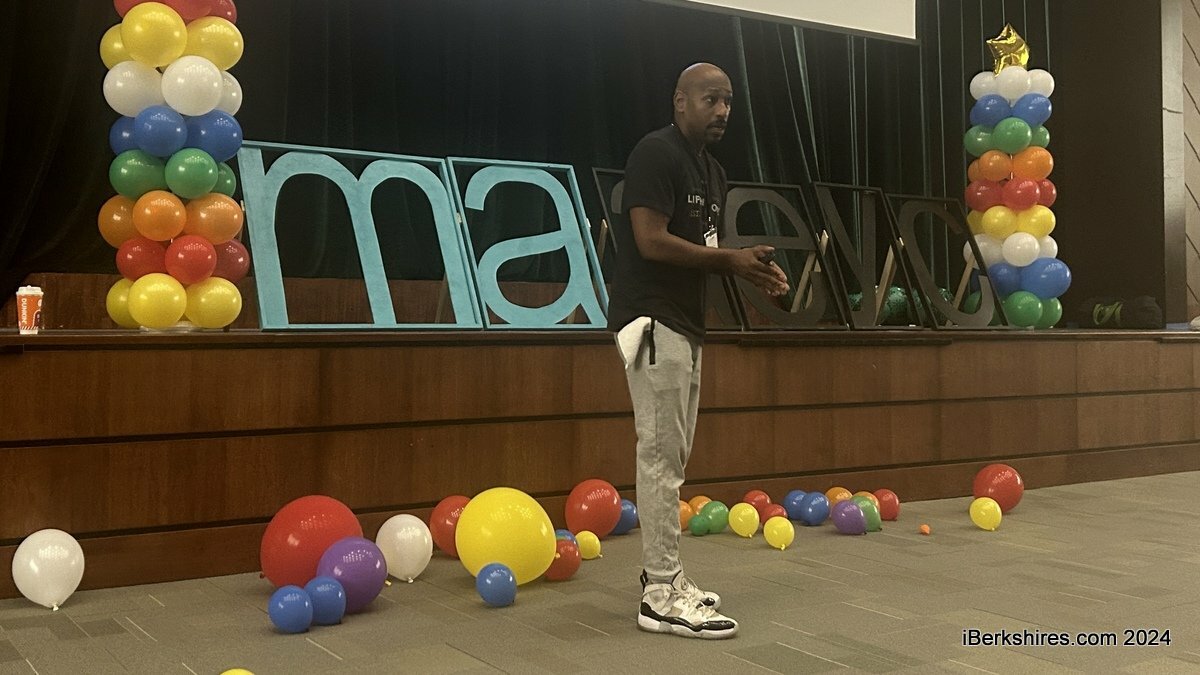

The day began with a keynote address from Anthony "Ant" Toombs Sr., senior playmaker guide and outreach specialist for the Life is Good Playmaker Project. It concluded at 3 p.m. after sessions, exhibitors, and a lunch break.

Toombs began by asking members of the audience to play rock-paper-scissors until there was one final winner. This was to increase energy and positivity while uniting people, he said, explaining, "Some folks who probably would have never had a face-to-face connection opportunity had that opportunity in here just now."

Life is Good donates 10 percent of profits to its kids' foundation. The Playmaker Project teaches early childhood professionals to help kids heal through play and, for 15 years, Toombs has worked with thousands to create environments that feel safe and joyous.

"Life is good but life is not so good for a lot of the children that we serve," he said.

According to the American Academy of Pediatrics, adverse childhood experiences are the single greatest unaddressed public health threat facing the nation. Toombs explained that these show up in forms of abuse, neglect, and household dysfunction, among others.

Coupled with this are the crucial brain developments made in the first five years of life and suggestions that the brain develops in use-dependent ways.

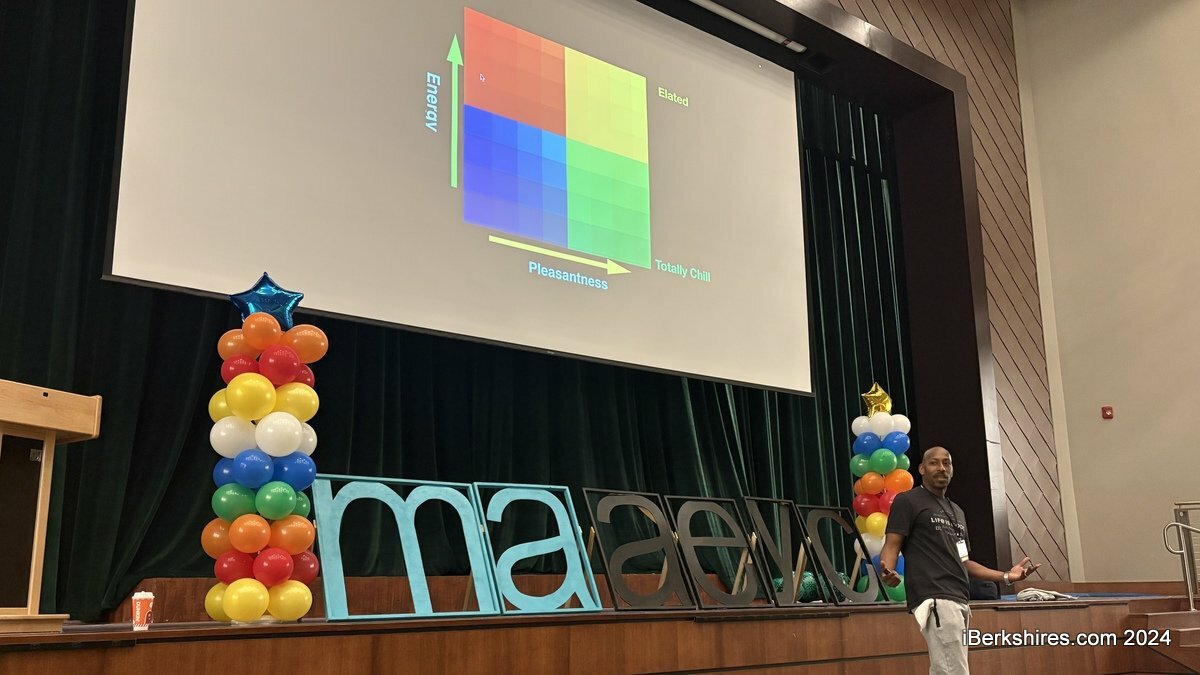

The presentation also detailed the reptilian cortex, the oldest part of the brain that is responsible for survival activities. When a young mind is not nurtured or faces trauma, he said they can revert to the survival brain and stressed the importance of "psychological first aid."

"I realized psychological first aid was simply showing up and being a human being," Toombs said, which could mean reminding a child to breathe or offering a glass of water.

The event was in collaboration with Taconic's Early Childhood CTE Program, Berkshire Community College's EEC Career Pathways Grant, and Berkshire United Way.

In 2023, the conference had 60 participants; this year, there were 204.

Alica Ginsberg, early childhood career pathway grant coordinator at Berkshire Community College, saw Toombs at the MAAEYC Conference in Worcester two years ago and was determined to get him on the program. She worked with MAAEYC to bring the conference to Berkshire County on a Saturday last year, focusing on diversity, equity, and inclusion initiatives.

This year Ginsberg, Katherine von Haefen, director of community impact at Berkshire United Way, and Sarah Muil, director of the Austen Riggs Nursery School advocated bringing the conference back to the Berkshires on a school holiday rather than a weekend and focusing on behavior, trauma and play.

BUW and Berkshire Taconic Community Foundation provided scholarships for 46 Berkshire educators to attend and Greylock Federal Credit Union sponsored an additional two.

The MAAEYC also offered conference participants $10 memberships.

Tags: conference, early childhood education, Taconic High,