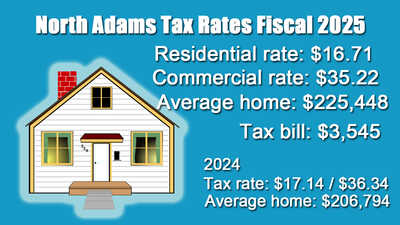

North Adams Property Owners to See Tax Rates Fall, Bills RiseThe City Council on Tuesday voted to maintain the split tax shift, resulting in a drop in the residential and commercial tax rates. However, higher property values also mean a $222 higher tax bill. Pittsfield Panel Supports $280K Winter Maintenance DeficitThe account is permitted to operate a deficit and has overspent $781,220. Curtis Says $200K Cut Won't Mean Staff ReductionsCurtis reported that the district would be comfortable bringing forward proposals for non-staff member cuts on June 26, sending out the information to committee member before hands. Clarksburg Officials Keep PreK Program FreeThey ended up agreeing to dip into their reserves to ensure that preschool will continue free for town residents. MCLA in Talks With Anonymous Donor for Art Museum, Art LabPresident Jamie Birge told the board of trustees on Thursday that the college has been in discussions for the last couple years with a donor who wishes at this point to remain anonymous. |