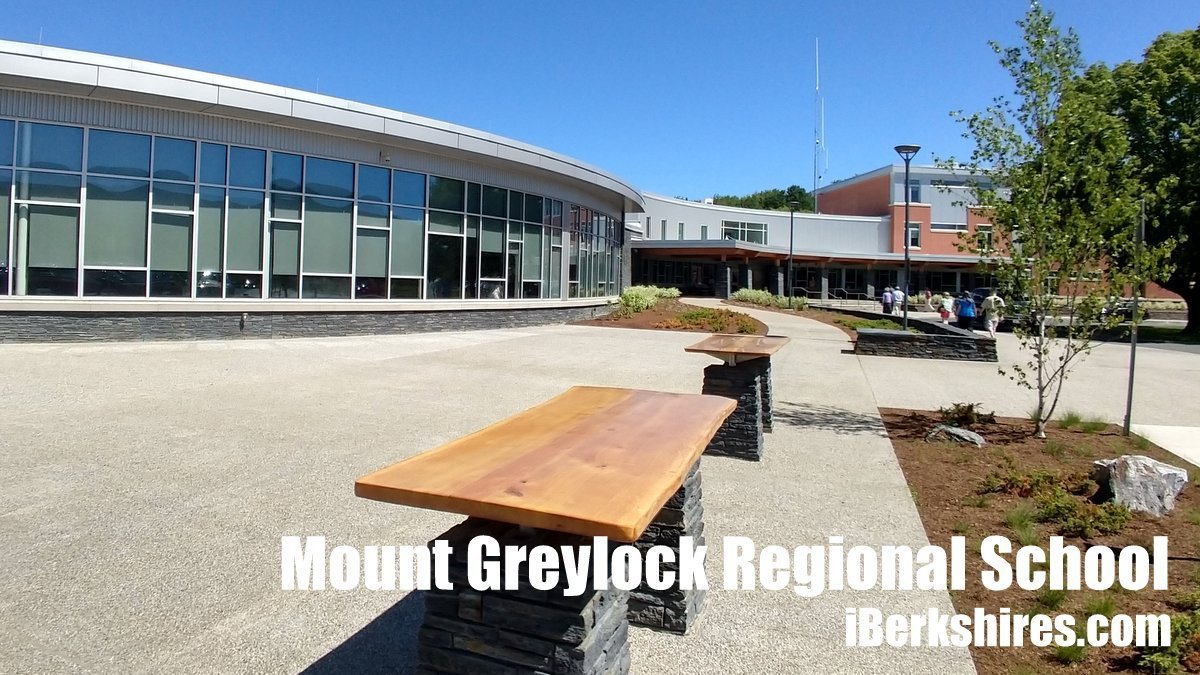

Pipe Failure Causes 'Significant Flooding' in Mount Greylock School

WILLIAMSTOWN, Mass. — A portion of the newly renovated Mount Greylock Regional School sustained significant water damage after a joint on a water main pipe failed on Friday, Superintendent Kimberley Grady said in an email to the school community on Saturday evening.

.JPG)

A "T-joint" failed in the wall between the Guidance Suite and first-floor bathrooms located near the gymnasium, causing the water to flow upward and shower through the ceiling tiles into the Guidance Suite and bathrooms.

According to the email, the water was quickly turned off, but "significant flooding" did occur in the Guidance Suite, bathroom and hallway leading to the gym. In the Guidance Suite, all offices have some water damage; Grady said some records got wet but nothing that can't be replaced.

Grady said in her email that contractors spent Saturday drying out the spaces and preparing them for restoration. Initial estimates are for the Guidance Suite to take between six and eight weeks to restore.

The bathroom should be restored much more quickly, as there was less damage, Grady said. The hallway is being evaluated for water damage.

As of 8 p.m. Saturday, Grady said, staff has laid out all wet items to start the drying process, met with the insurance company, contacted the flooring company and developed a plan to relocate guidance staff as well as safely dry and store confidential student files during the restoration process. The electrical work has been inspected, she said.

There will be some disruption to staff and students, she said: The guidance staff is being relocated to the library, so classes that were taught in the library will have to be moved to other classrooms in the academic wing for the duration of the restoration.

Grady said in the email that In conjunction with the school's insurance company, a root cause analysis is being done to find out why the T-joint failed. An insurance adjuster has been in and has asked that school bring in an engineer to look at the pipes on Monday.

This is not the first pipe leak the school has experienced, she said, there was one in the art room in October or November and in the stained glass room just two weeks ago.

Tags: MGRS,