Pittsfield Housing Development Seeks Local, State Incentives

PITTSFIELD, Mass. — Mayor Linda Tyer is requesting an amendment to the Housing Development Zone and a 10-year tax increment exemption for a proposed housing development on Wendell Avenue.

786 Holdings LLC wants to convert a commercial building at 100 Wendell Ave. into 28 units of mixed-income rental. The "Pointe" will contain six units of affordable rental housing and 22 units of market-rate rental housing. The $3.8 million redevelopment would bring the assessed value of the property from about $517,000 to more than $1.8 million.

Proposed initial monthly rents range from $999 for a studio to $1,225 for a two-bedroom unit.

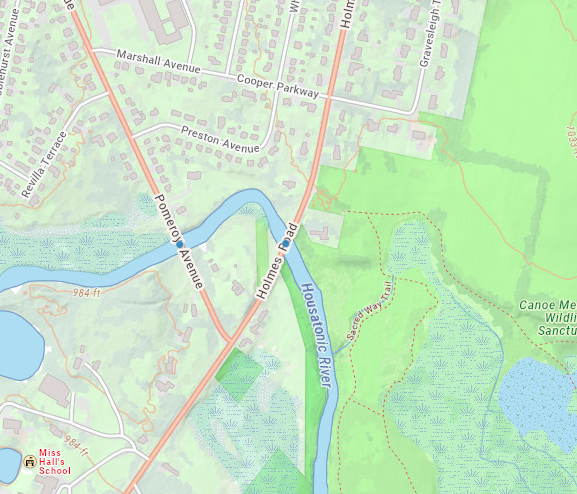

"In order for this project to be eligible for assistance through the (Housing Development Incentive Program,) the City must amend the current HD Zone to include the 100 Wendell Avenue property," Tyer wrote in a communication on Tuesday night's City Council agenda.

"In reviewing the existing parcels surrounding the HDIP Zone, the City is also including the parcel at 55 Linden Street as it has the potential for housing development."

The TIE would provide 100 percent forgiveness on new residential property taxes in year one and decrease by 10 percent each year over 10 years. The estimated value of the TIE is just over $147,000 and the city would receive taxes on the original value of the property during construction.

The HDIP program requires the local government to provide a TIE for the project

The program, which is administered through the state Department of Housing and Community Development, was credited during Gov. Maura Healey's visit to Pittsfield last week for aiding the development of multiple housing units.

The HDIP provides two tax incentives to developers to undertake new construction or substantial rehabilitation of properties for lease or sale as multi-unit market-rate residential housing: The local tax exemption in gateway cities and a state tax credit of up to $2 million, for which the annual cap was increased from $10 million to $57 million in a $1 billion tax package signed by Healey earlier this month.

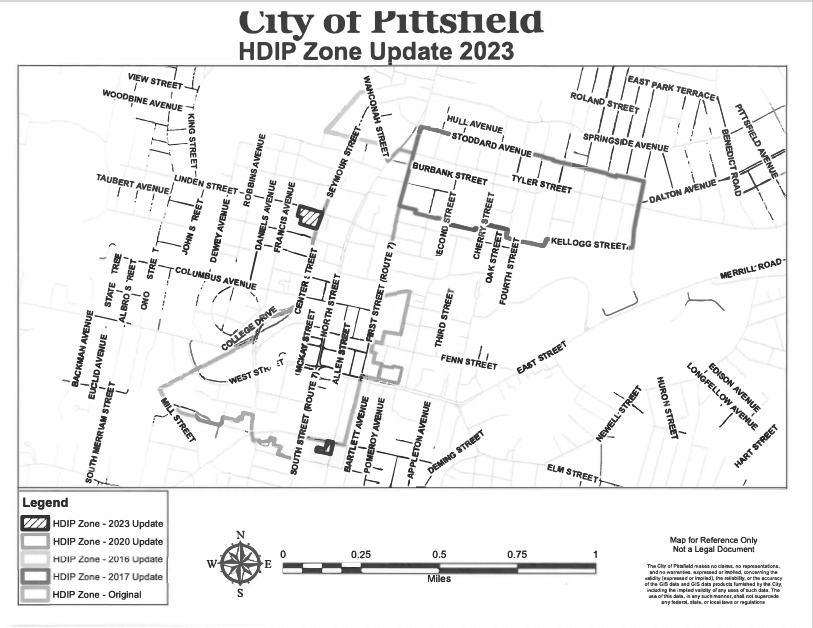

Since it was adopted by the city in 2012, it has been used to create 144 new housing units and rehabilitate properties that were underutilized including former churches, vacant commercial space in the upper level of commercial buildings downtown, and a vacant firehouse.

Tyer said none of those projects would have been possible without the HDIP and that they have brought new residents to the urban center of the city while stimulating economic development in the downtown and surrounding area.

"The City has a critical need for all types of housing and across all income levels Market rate housing is housing that is affordable to households with different income levels without subsidies or caps on the sales price or rent," she wrote.

"In market rate housing there are no rent restrictions, the owner may rent the unit at whatever price the local market can bear. With 3 affordable housing projects underway in the downtown and surrounding areas, representing 77 units of housing, there is also a need for market-rate housing units in order to provide a balance of housing opportunities."

She reported that a market study by LOS Consulting for the original HD Zone revealed that many prospective buyers of condominiums and homes have not been able to qualify for a mortgage and are returning to the rental market and that new quality market-rate housing in the downtown coupled with the revitalization and cultural efforts in the downtown should draw higher income households into the downtown.

Also in 2012, the City Council approved a new housing development zone for those intending to utilize the HDIP. It was subsequently approved by the state.

For new market-rate housing created in this HD Zone, the program provides up to $1 million in tax credits per project as well as a local tax increment exemption (TIE) to private developers.

A second amendment to the HDIP zone was approved on Nov. 15, 2016, to add the PowerHouse Lofts project located at the former Holy Family Church to the HDIP Zone, allowing the church to be converted into market-rate housing. An amendment to the zone to include Tyler Street was approved in May 2017 and in September 2020, the city amended the zone to include a parcel on East Street to include the Eastview Apartments, the conversion of a former church building into 27 units of rental housing with one affordable unit included.

Tags: housing, tax incentive,