BRPC Releases Draft Safe Travel and Equity Plan for Streets

PITTSFIELD, Mass. — With the help of federal and state funds, the Berkshire Regional Planning Commission is trying to make streets safe and equitable for all modes of transportation.

Last week, a draft action plan was released for the Safe Travel and Equity Plan for our Streets (STEPS.) The long-term project aims to reduce fatalities and serious injuries in traffic and non-modal accidents.

Community members gathered at the Berkshire Innovation Center and virtually for a public meeting on the effort on Thursday.

"In 2021 almost 43,000 people were killed in motor vehicle crashes across the United States. Of which, 7,300 were walking," Senior Transportation Planner Nicholas Russo explained.

"And millions more were injured — sometimes permanently — each year."

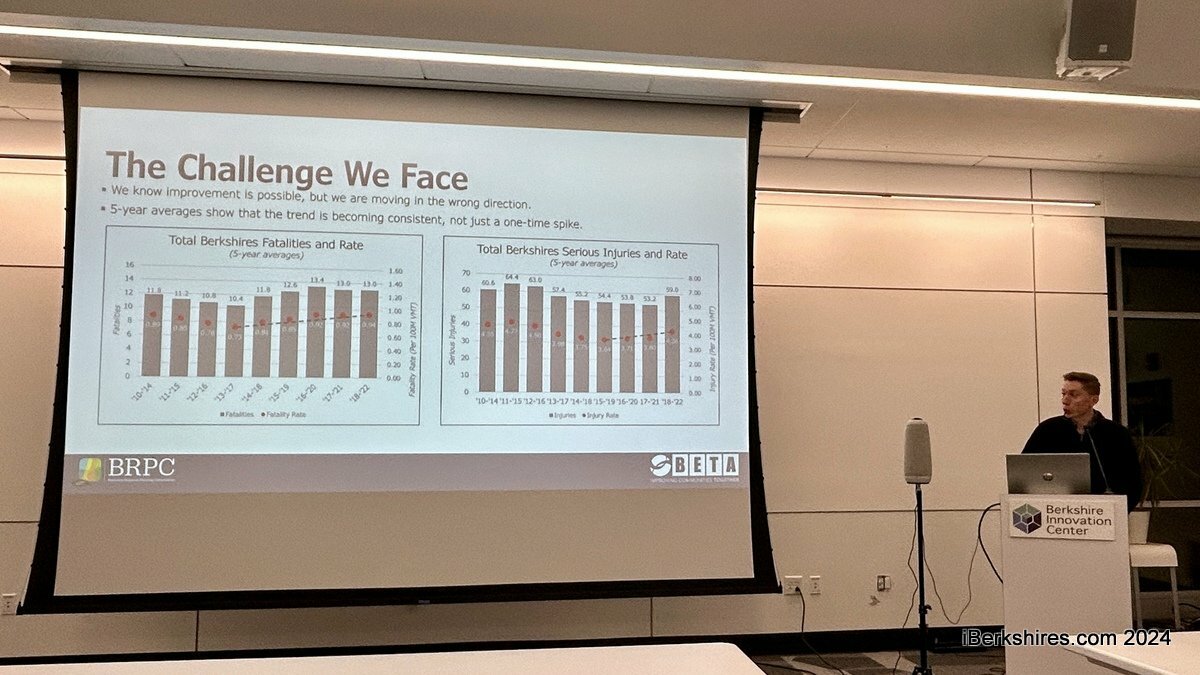

Five-year averages for Berkshire County show a consistent upward trend, with 13 fatalities from 2018 to 2022 and a 0.94 fatality rate per 100 million vehicle miles traveled. For the same period, there were 59 series injuries at a rate of 4.26 per 100M VMT.

Between 2018 and 2022, 12 vulnerable or non-motorized road users were killed or serious injuries.

"So what are we doing about it? We're adopting the safe system approach through the Safety Action Plan. A safe system looks at our transportation system from more angles than just people and their vehicles and behaviors," Russo said.

"The guiding principles that inform the safe system are that any death or serious injuries on our roads are unacceptable and if there are, we know there’s more work that needs to be done."

BRPC was awarded about $200,000 from the Safe Streets and Roads for All federal funding program and about $50,000 from the Massachusetts Department of Transportation to conduct the plan and make way for future implementation funding to get recommendations online. Implementation grants can range anywhere from $2.5 million to $25 million.

Earlier this year, BRPC, working with consultation partners at BETA Group Inc., began to develop a Comprehensive Safety Action Plan informed by crash data. The process included public meetings, an online survey, municipal stakeholder interviews, and a comprehensive review of regional crash data.

On Nov. 4, the draft action plan was released for public review and comment.

The STEPS initiative aims to reduce fatalities and serious injuries to zero, or "Vision Zero," focus resources equitably on communities that could benefit most from reducing casualties and increasing transportation options, and continues to track safety statistics in the county.

Russo acknowledged that there is always going to be the possibility of human error in the transportation system and they can’t possibly legislate or eliminate all mistakes made by road users.

"We know responsibility is shared, not just between other travelers but between the people who design, who legislate, who enforce, and plan on roadway systems so we all need to take a part in reducing these numbers," he said.

"We know the safety is proactive, that we should try and look forward and prevent crashes from happening before where they occur based on what we know from the past, and redundancy in the system is crucial."

The initiative points out that law enforcement can only do so much and creating streets that are self-enhancing helps everyone. This includes streets designed for a desired target speed rather than accommodating the speed of traffic, making non-vehicular options attractive, and designing for the surrounding environment.

This could look like best practice designs for bicycles, closing sidewalk gaps, continued ADA upgrades, well-maintained road infrastructure, trafficcalming measures, and access management on busy roads.

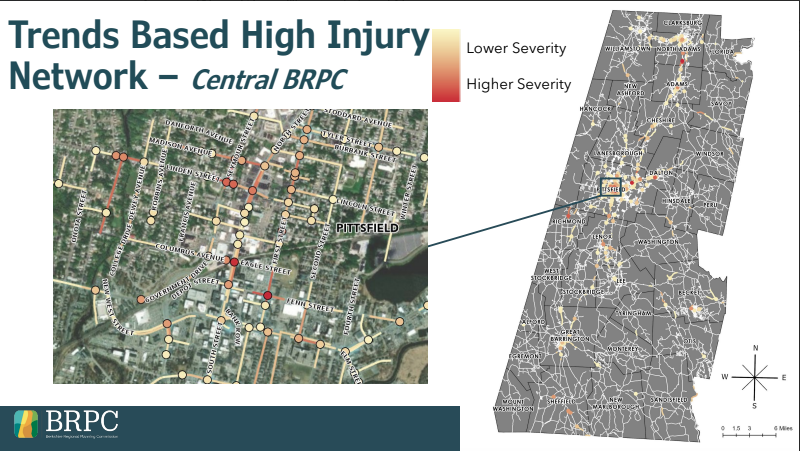

The action plan identified places in the county with known fatalities and injuries as well as high-risk locations, forming a High Injury Network map. Pittsfield has the first seven priority locations, with the First Street, Tyler Street to Fenn Street corridor coming in at No. 1 with seven fatal or serious injury crashes and 68 injury crashes.

Recommended countermeasures include curb extensions at crosswalks, raised crosswalks, bike lanes, and longer pedestrian crossing times.

"Our ultimate goal is to reach zero by 2040," Russo said.

"I know that seems very far away but that basically tracks with how we had been seeing our progress trending before we started going in the wrong direction so I think that kind of gives us a baseline that's realistic and achievable but something we have time to work towards and to figure out as we go."

The action plan will be presented to the Berkshire Metropolitan Planning Organization in early 2025 and the SS4A program will be funded through 2026.

During the question and answer portion, residents pointed out parts of the county that may need safety features for pedestrians, including College Way in Pittsfield and Church Street on the Massachusetts College of Liberal Arts, where a student was recently hit in the crosswalk.

"We have so many angry drivers, people who feel entitled, and I think it's part of where we have to come together and care about each other a little more," said Marjorie Cohan, Berkshire Bike Path Council president.

Another resident pointed out that pedestrians also need education so that they can avoid behaviors that may result in a crash.

Berkshire County residents are invited to review the draft report and provide feedback during the comment window from Nov. 4 through Dec. 2.

Tags: pedestrians, safe streets, traffic safety,