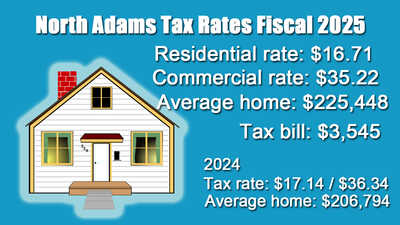

Software Glitch Caused Clarksburg Tax Bill ErrorOfficials say a software glitch caused the third-quarter property tax bills to include interest through the fourth quarter. Dalton Town & Fire District Set Tax Rates for FY26The Select Board voted to maintain a single tax rate, as it has done historically, during its meeting on Monday night. Pittsfield Council Sets FY26 Tax RateThe City Council has set the fiscal year 2026 tax rate: $17.50 per $1,000 of valuation for residential property and $36.90 for commercial, industrial, and personal property. North Adams' Average Tax Bill Climbs $126; McCarron Sworn in as CouncilorThe City Council on Wednesday approved a split tax rate that maintains a shift of 1.715 to business and commercial properties. Pittsfield Tax Rate Drops, But Bills May RiseThe administration has presented a split rate that would increase the average single-family home's annual bill by about $220. Lanesborough Tax Rate Up 3%The Select Board has adopted a single tax rate that will increase the average homeowner's annual bill by about $350. Clarksburg Has Buyers for Cruisers; OKs Exemption Income HikeThe board had voted to dissolve police department in March and rely on the State Police. The two cruisers, including one purchased in 2021, have been taking up space in the garage ever since. Berkshire Village Owners Owes Cheshire Back TaxesIn addition to residents complaints about Berkshire Village's deteriorating condition, the mobile home park also owes the town roughly $21,000 in back taxes. Divided Williamstown Select Board Implements Senior Tax ExemptionThe annual town meeting overwhelmingly supported the home rule petition, which was waiting on approval from the legislature and the signature of the governor before the local property tax relief plan could be put into action. Williamstown Expects Spike in Property Taxes in FY26No details were revealed about the town's fiscal year 2026 spending plan at Monday's joint meeting of the Select Board and Finance Committee. But it was apparent that FY26 budget will require a significant increase in the property tax levy in the year that begins July 1. Clarksburg Sets Tax Rate; Interviews TA CandidateThe Select Board on Monday night voted after a tax classification hearing to again maintain a single tax rate. Members also interviewed the first candidate for the town administrator post, former Select Board Chair Ronald Boucher. Dalton and Fire District Set Tax Rates for FY25The Select Board voted to maintain a single tax rate, as it has done historically, during its meeting on Monday night. Lanesborough to Mall Owners: Pay Your TaxesThe owners say they are plagued by the costs of stabilizing a rundown property that should not have gotten to its current state and cite "inhibitive" taxation from the Baker Hill Road District. Lanesborough Sets Single Tax Rate, Bills to IncreaseThe average homeowner's tax bill for fiscal year 2025 will rise about $360. Pittsfield Tax Rates Down But Values Mean Increased BillsOn Tuesday, the City Council approved a residential tax rate of $17.94 per $1,000 of valuation and a commercial, industrial, and personal property tax rate of $37.96 per $1,000 of valuation. North Adams Property Owners to See Tax Rates Fall, Bills RiseThe City Council on Tuesday voted to maintain the split tax shift, resulting in a drop in the residential and commercial tax rates. However, higher property values also mean a $222 higher tax bill. Williamstown Finance Sees Pressure on Property Tax BillsA stagnant local economy promises to put increasing upward pressure on local tax bills. Williamstown FY25 Tax Bills Up Slightly, Tax Rate Falls AgainThe median property tax bill for fiscal year 2025 is expected to see its lowest year-to-year increase since 2019, the Select Board learned on Monday night. |