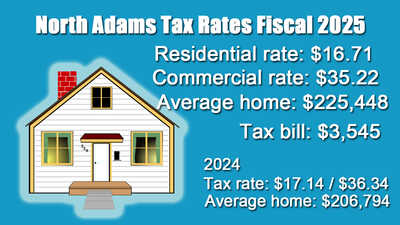

Clarksburg Average Tax Bill Up 4%The owner of an average home will see their tax bill rise by about $132, or about 4.16 percent. Dalton Town & Fire District Set Tax Rates for FY26The Select Board voted to maintain a single tax rate, as it has done historically, during its meeting on Monday night. Pittsfield Council Sets FY26 Tax RateThe City Council has set the fiscal year 2026 tax rate: $17.50 per $1,000 of valuation for residential property and $36.90 for commercial, industrial, and personal property. North Adams' Average Tax Bill Climbs $126; McCarron Sworn in as CouncilorThe City Council on Wednesday approved a split tax rate that maintains a shift of 1.715 to business and commercial properties. Pittsfield Tax Rate Drops, But Bills May RiseThe administration has presented a split rate that would increase the average single-family home's annual bill by about $220. Lanesborough Tax Rate Up 3%The Select Board has adopted a single tax rate that will increase the average homeowner's annual bill by about $350. Adams Sees Tax Rate Drop; Property Tax Bill to Rise 2%The Board of Selectmen set a split tax rate, which means $15.63 per $1,000 valuation for residential and a 30 percent shift at $21.50 for commercial, industrial and personal property with Selectman Joseph Nowak voting no. Williamstown Taxpayers to Start Paying for New Fire StationThe main driver is the start of bond payments on the new station nearing completion on Main Street, which accounts for most of an approximately $893,000 increase in the district's levy. Clarksburg Sets Tax Rate; Interviews TA CandidateThe Select Board on Monday night voted after a tax classification hearing to again maintain a single tax rate. Members also interviewed the first candidate for the town administrator post, former Select Board Chair Ronald Boucher. Dalton and Fire District Set Tax Rates for FY25The Select Board voted to maintain a single tax rate, as it has done historically, during its meeting on Monday night. Lanesborough Sets Single Tax Rate, Bills to IncreaseThe average homeowner's tax bill for fiscal year 2025 will rise about $360. Pittsfield Tax Rates Down But Values Mean Increased BillsOn Tuesday, the City Council approved a residential tax rate of $17.94 per $1,000 of valuation and a commercial, industrial, and personal property tax rate of $37.96 per $1,000 of valuation. North Adams Property Owners to See Tax Rates Fall, Bills RiseThe City Council on Tuesday voted to maintain the split tax shift, resulting in a drop in the residential and commercial tax rates. However, higher property values also mean a $222 higher tax bill. Pittsfield Tax Rate May Drop But Bills RiseThere will be a tax classification hearing during Tuesday's City Council meeting, which begins at 6 p.m. Adams Taxpayers Will See Rates Drop, Bills IncreaseThis sets the residential tax rate for the coming year to $17.01 per $1,000 valuation, a 53 cent decrease. The debt for the Hoosac Valley High School is $1.02 of the rate. Williamstown FY25 Tax Bills Up Slightly, Tax Rate Falls AgainThe median property tax bill for fiscal year 2025 is expected to see its lowest year-to-year increase since 2019, the Select Board learned on Monday night. |